Financial reflection: Learning from your spending habits

How we manage and feel about money can have a significant impact on both our financial goals and overall wellbeing, which is why it’s important to reflect on your financial behaviour.

Looking back at your spending habits, attitude towards money and finances, and reasons for spending could help provide clarity on why you made those spending decisions.

What is financial reflection?

Reflecting on your finances means taking a closer look at your spending habits over a period (months, years, decades). By taking an objective view of ‘what has been’, you can see what has worked for you and what hasn’t.

Evaluating the past outcomes gives you valuable insights that can help you make better financial decisions and put you on a more solid financial footing going forward.

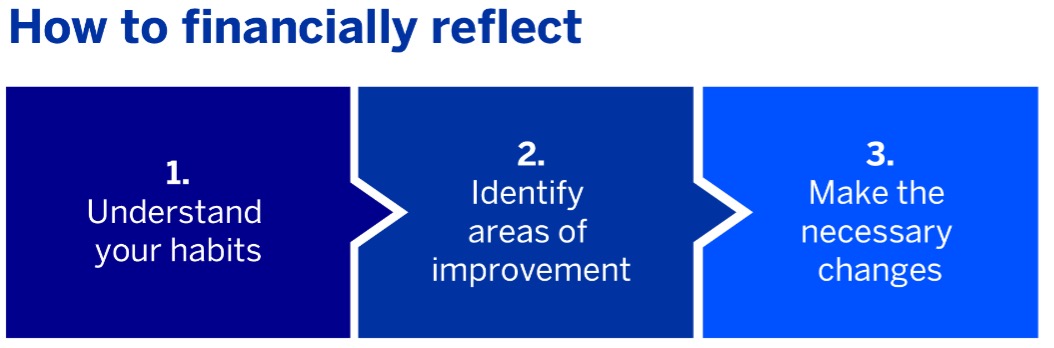

1. Understand your habits

Look at your money movements over the past year and the categories where your money went, including

your spending, saving, investing, borrowing, taxes and money you gave away (to causes, charities, friends and family). Compare how much you spent in each category. What you spent money on can reveal your priorities and the things you value but also indicate whether you spend with your ‘heart or head’.

To help understand your habits, ask yourself, “What did and didn’t work, and why?”

2. Identify areas of improvement

Based on what you answered to the first 2 questions and where you have identified most of your money going, you can single out 2 or 3 money changes that you’d like to make. This will also help you see where there are areas that you can save more money.

For example, if you look at your expenses and identify that you dine out a lot but it’s also because you do it as a social event/entertainment, consider cooking at home more often and rather than meeting at a restaurant, invite your friends over to your place or for a picnic to help you cut back on this expense.

|

Top tip Start small and prioritise 2 or 3 areas of improvement at a time. Trying to change everything at once can be overwhelming and can leave you feeling demotivated. |

3. Make the necessary changes

Once you’ve determined which areas you’d like to improve, take the time to decide how you’re going to do so. Knowing what you want to change will narrow down the options of how to change it.

Remember to set realistic goals and give yourself a timeframe for achieving them.

For example, do you want to save more money or pay off debt? Either one will need a plan, and you need to look at how it will fit into your budget. Start a habit where you set up an automated payment into a savings account as soon as you’re paid so that you can build towards that goal.

Use our Banking App and the add-on features to help your new habits stick and to help you keep track of your progress.

*Terms and conditions apply. Network costs only apply to downloading the app.

Disclaimer: This article is solely intended for information. It does not constitute financial, tax or investment advice or recommendation. Please speak to a financial advisor or registered financial professional before making any financial decision(s).

Standard Bank, its subsidiaries or holding company, or any subsidiary of the holding company and all of its subsidiaries make no warranties or representations (implied or otherwise) as to the accuracy, completeness or fitness for purpose of the information provided in this article or that it is free from errors or omissions.