Tap, Sell, Grow: How Digital Payments are Powering SME Growth

The way South Africans pay, and get paid, is changing fast. For small and medium enterprises (SMEs), this shift isn’t just about adopting new technology; it’s about transforming how business is done.

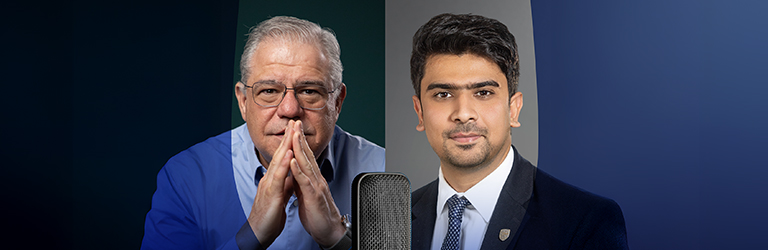

In a recent conversation with Aki Anastasiou, Muzzafar Nagvadari, Executive Head for Merchant Solutions at Standard Bank Business & Commercial Banking, explored how digital payments are evolving from simple transactions into powerful tools for business growth.

From Card Terminals to Connected Ecosystems

Gone are the days when a card machine was all a business needed. Today’s entrepreneurs require a Unified Commerce ecosystem, one that connects every part of their business, from in-store payments to online sales, invoicing, inventory and accounting.

“Managing multiple systems in silos drains time, money and energy,” says Nagvadari. “SMEs need a single platform that simplifies operations, delivers insights and improves cash flow in real time.”

That’s where Standard Bank’s SimplyBLU comes in. It’s not just a card machine; it’s a small business operating system designed to unify how entrepreneurs sell, track and grow.

Simplifying Business: Amplifying Growth

SimplyBLU brings together everything an SME needs to run smarter:

- Unified sales view: It connects all sales channels – card payments, invoices, and digital transactions – into one dashboard.

- Effortless admin: Reconciliation and reporting happen automatically, freeing entrepreneurs to focus on growth.

- Instant online presence: Its built-in store builder lets businesses launch an e-commerce shop in hours, not weeks.

This unified approach eliminates the biggest source of frustration for many small business owners, manual admin, and replaces it with real-time visibility and control.

The Rise of Real-Time Finance

Cash flow remains the biggest threat to SME survival. New payment infrastructure like PayShap is changing that by enabling instant settlement of funds, allowing businesses to access their money the moment a sale happens.

“Standard Bank is building on this capability to help SMEs move beyond waiting for cash flow,” explains Nagvadari. “We’re using real-time payment systems as a foundation for real-time business growth.”

Turning Transactions into Intelligence

Every tap, swipe, or online payment holds valuable insight. When analysed, payment data reveals trading patterns, best-selling products and customer behaviour. These insights allow business owners to make informed decisions – what to stock, when to promote and where to invest.

“The payment terminal is no longer just a way to collect money,” says Nagvadari. “It’s a data engine that helps entrepreneurs run their businesses more intelligently.”

By treating payments as a source of business intelligence rather than a mere cost, SMEs can strengthen decision-making and stay ahead of competitors.

The Future: Embedded Finance

The next frontier is Embedded Finance, where financial tools become seamlessly integrated into everyday business systems. Imagine a future where SimplyBLU detects when your inventory runs low and, using your real-time sales data, automatically triggers a pre-approved working capital loan to restock before you miss a sale.

That’s the direction Standard Bank is heading, towards financial solutions that are proactive, personalised and built around the real-world rhythm of business.

Advice for Entrepreneurs

To stay competitive in this rapidly digital world, Nagvadari offers two key principles:

- Demand Unification: Stop managing different sales channels separately. Choose a platform that integrates everything into one.

- Demand Intelligence: Expect your payment platform to provide insights, not just totals. Use your transaction data to plan ahead, optimise cash flow and identify growth opportunities.

With the right partner and the right platform, SMEs can move from simply transacting today to growing sustainably tomorrow.