Young money: 5 Finance basics to live by

Making smart money moves as a young adult will help you build a healthy financial future, and it starts with taking control of your finances and knowing the dos and don’ts of money.

The good news is that you don’t need a fancy degree to manage your finances; once you understand the basics, you can start living your best financial life.

Here are 5 basic finance tips to help ensure your financial wellbeing:

1. Spend less than you earn

It can seem difficult to do when you see that new pair of sneakers but being responsible with how you spend your money is crucial to your financial wellbeing. Staying disciplined about spending within your means will help you keep out of debt and on track for a healthy financial future.

2. Know where your money is going

A budget is the easiest and most effective way to manage finances and create a plan for your money:

- Work out how much you earn after tax; this is the real amount you’ve got to get through the month.

- Create a list of what you’re spending your money on each month and add it up.

- Review that list to see whether you can cut some expenses. The goal is for your expenses to be less than your after-tax amount and to have some left over to save.

It doesn’t need to be restrictive, just realistic so you can control your spending according to your priorities and work towards achieving your goals.

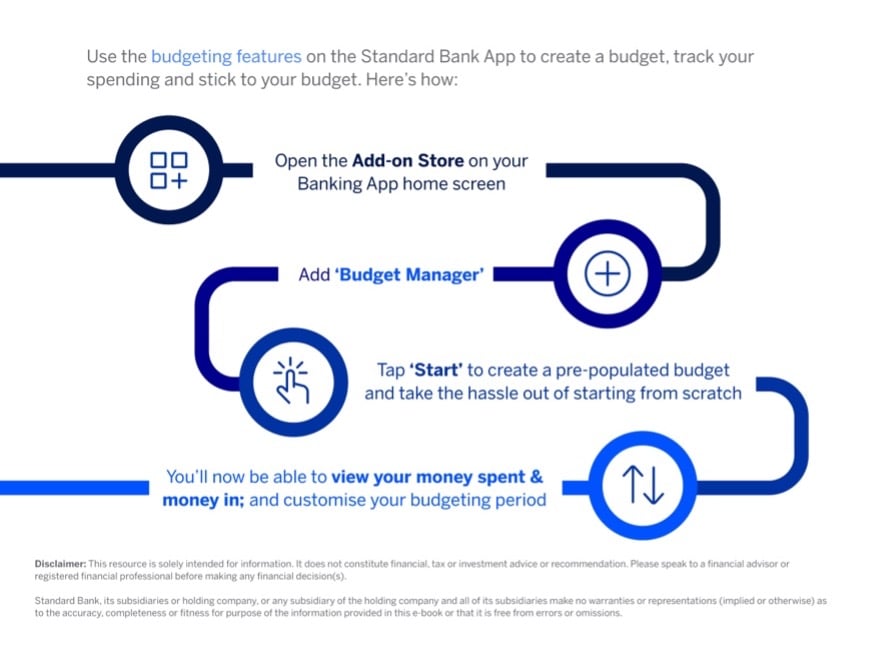

Use our Banking App to stay on top of your budget and your money movements. You can also use it to make quick and easy payments, buy airtime and data, and open accounts that help you save and grow your money.

3. Understand how credit works

Accessing credit, e.g. through a credit card, makes life convenient, and it helps you build a credit score, which will work in your favour when you need to borrow money for a house or a car one day.

However, if you’re constantly overspending, paying back the money becomes more expensive and can put you in a debt trap. Not only is it stressful but it reflects badly on your credit score and your ability to do the things you want in the future.

4. Get into the habit of saving

Dedicate a certain amount of your income every month to savings and do it before you start spending your money.

- Set money aside for ‘surprise expenses’ (e.g. a flat tyre or medical emergency). This will help lessen the blow when you’ve got to cover the cost of something unexpected.

- Consistency is key. Even small amounts add up. An easy way to ensure that you’re consistently saving is to automate your savings, which you can quickly set up on our Banking App. Our Banking App also makes it effortless to transfer money from your transactional account into your savings account and have a simultaneous view of both.

- The biggest advantage of starting to save when you’re young is that it gives you more time for your savings and investments to grow.

Use our Savings and Investment Product Filter to help you determine which savings account works best for your needs and your wants.

5. Don’t try to keep up with your friends

When it seems everyone except you is going on expensive holidays or making big strides in life, it’s easy to feel left behind, but trying to compete will just put you back even further.

Remember, you’re on your own financial journey, and you’re not obliged to keep up with anyone else’s lifestyle. Stick to your goals and you’ll get there.

Building a strong financial foundation

Building a strong financial foundation isn't just about numbers; it's about taking control of your future. By mastering these financial basics, you're not just managing money, you're investing in yourself. Start building smart habits today to set yourself up for a future filled with financial confidence and wellbeing.

*Terms and conditions apply

Disclaimer: This article is for information purposes only and does not constitute financial, tax or investment advice. Readers are strongly encouraged to seek financial or legal advice before making any decisions based on the content.

Standard Bank, its subsidiaries or holding company, any subsidiary of the holding company and all of its subsidiaries, make no warranties or representations (implied or expressed) as to the accuracy, completeness, or suitability of the content of this article. The use of the article and any reliance on the content is at the reader’s risk.