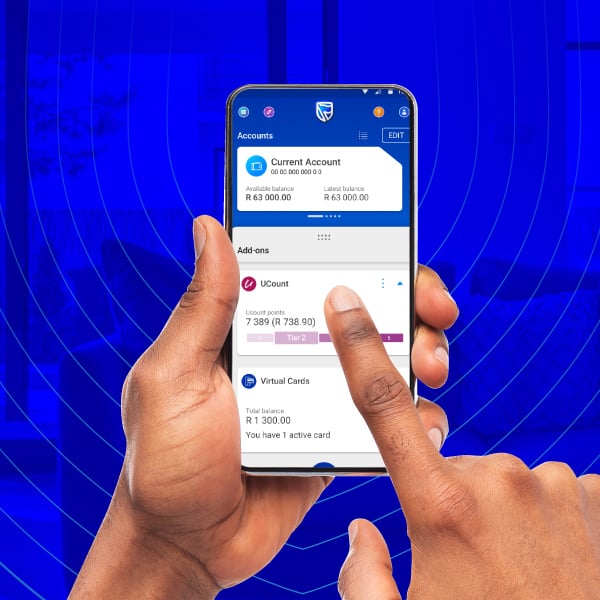

Use our Banking App

Discover secure and effortless tools that help you track your money usage, get stamped bank statements, manage your cards and their limits, and explore personalised offers – all at your fingertips.

Reasons to use our Banking App

Safe and secure

Convenience

Control your accounts

Get notified

Learn how to use our Banking App by going through our step-by-step guides

No. If you’re a Vodacom, MTN, Cell C and Telkom customer you will not be charged data fees for using our app.

View our step-by-step Help Guide on how to get your bank account documents.

Our app only works on devices with:

- Android version 6 or higher

- iOS version 15 or higher

We recommend that you update the operating system of your device to enhance the security and stability of your device. Go into your device’s settings and select to update the software. The Banking App will not work on devices that are not supported by the device manufacturer and poses a security risk.