Visualise your investment

Visualisation refers to the ability to imagine what we wish to see in our lives before it becomes reality. It can have an enormous impact on our decision-making abilities.

One of the biggest obstacles that people have to overcome is the so-called ‘saver’s block’. If you think about it, most people save very little and, in some cases, nothing at all. It is the ‘little things’ that get in the way: our fast-paced lifestyle, the ‘YOLO’ (you only live once) mentality, lavish spending, a lack of planning and an ever-increasing debt burden.

A big part of this ‘little things’ dilemma is that most of us seek instant gratification at the expense of our current and future financial freedom. We want our benefits today and we want our problems to be dealt with in the future. This is a problem across the board, from the lower end of the market right up to the more affluent members of society.

Why is it so difficult to set aside money for long-term goals?

According to the Institute of Behavioural Finance, people generally find it difficult to picture themselves in the future, as their ‘present self’ is completely disconnected from their ‘future self’. A study called Behavioural Finance in Action found that the human brain perceives the ‘future self’ in the same way it perceives a stranger. This disconnect makes it difficult for people to commit to investing for long-term financial goals.

How can I overcome these difficulties?

Sometimes even the most compelling arguments will not necessarily result in a behaviour change. We know, for example, about the dangers of not saving. However, more often than not, this knowledge is not sufficient to persuade people to change their lifestyles for the better.

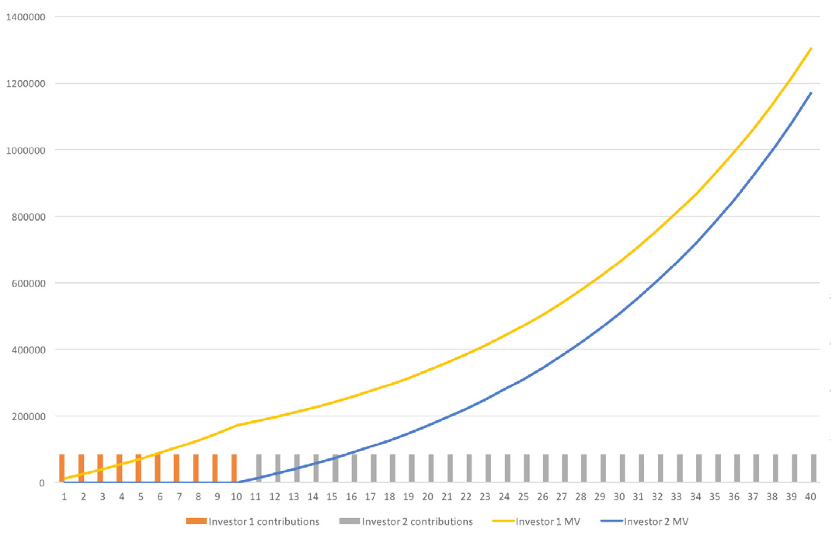

Behavioural science offers a fresh perspective on how we can go about convincing more people, especially the younger generation, to start taking long-term investing seriously. One of the techniques we can use is the art of visualisation as you can articulate and accomplish your life goals better when you have visual aids. Instead of thinking about the effects of saving too little or delaying savings, you can use visuals like this one to get the message across:

What are the effects of delayed investing?

Investor 1 (yellow line): Contributed R1 000 per month for 10 years. Then he stopped contributing but remained invested for another 30 years. His total contributions: R120 000. Market value after 40 years is R1 302 174.

Investor 2 (Blue line): Delayed investing for 10 years, then contributed R1 000 per month for 30 years. Total contributions were R360 000. Market value after 40 years is only R1 169 453.

This graph demonstrates the power of compound interest. Compounding works in your favour when you invest sooner and for longer, so Investor 1 will reap greater financial returns even though he stopped his contributions after 10 years. It also shows that the longer you wait to start saving, the harder it will be to reach your goals.

Your first 10 years are more important than your last 10 years

Source: Allan Gray, SMM

You can also use lifestyle images to demonstrate the differences between what you can afford now and what you can afford when you invest for the future. For example, as you move along the savings graph below, you can see that based on the amount saved, the result gets better and better:

Changing belief into action

Financial researchers have always been puzzled by the disconnect between what people believe they should be doing financially and what they are actually doing (belief versus action). You can take action by:

- Visualising your future self and your estimated life span (the reality of living longer and what it means).

- Choosing investment solutions that perform well over the long-term and that comes with both growth and protection (refer to our Goal Standard Funds).

- Saving for the long-term (the true cost).

- The advantages of saving earlier and the benefits of compound interest.

The importance of setting and prioritising goals

You can set clearly defined financial goals based on your vision of what you would like to achieve, and determine a timeframe for achieving it. You can do this by:

- Making a list of needs and wants. Write down everything you need and want to do. You should list your needs (must-haves) and wants (like to have) separately

- Determine a timeframe. Separate your needs and wants into short-, medium- and long-term goals and assign a specific timeframe to each.

- Prioritise. Go through the list and assign a numerical rating to each goal with ‘1’ being most important. Prioritise each goal based on a timeframe (in other words, important short-term goals should take priority over longer-term goals).

- Determine the cost. Estimate the cost and calculate the monthly savings required to achieve each goal.

Once your goals have been defined, you can develop a financial plan, including specific investment solutions appropriate to your different goals. It will also be helpful to revisit this action plan annually since your needs and wants will more than likely change throughout your various life stages.