Understanding the basics of credit cards

There are many good reasons to get a credit card, and choosing the right one for your needs and spending habits can help you achieve your financial goals efficiently and affordably.

It’s important to understand the basics of credit cards so you can use it wisely, avoid the potential pitfalls and start building good credit. Here’s a guide to navigating the ins and outs of credit cards: what you should know before you get one and what to keep in mind once you have one.

Understand how credit card works

A credit card is a useful tool to help manage your cash flow and provide flexibility to pay for major purchases. It works by giving you access to a pre-approved amount of money that you can spend, provided your account is in good standing, up to a predetermined limit. You’re then required to pay the money back within a set time: either all of it or at least a minimum amount. If you’re only paying back the minimum amount, you’ll be charged interest on the outstanding amount.

Benefits of a credit card

A credit card allows you the flexibility and convenience to make purchases today and pay off the amount due at a future date. Since you don’t have to carry specific cash amounts around, it’s a more secure way to pay. Plus, it could save you time and money because you don’t have to go to an ATM or be charged to make a withdrawal.

Shopping online is also quick, easy and secure, and you can switch your credit card on or off with our Banking App or link it to other apps to make payments with your phone. Your credit card also gives you a 55-day interest-free period to pay back the money spent on your card, meaning you won’t be charged interest on your outstanding balance provided you pay the closing balance in full by the payment due date.

Every time you swipe, tap or use your credit card to make a purchase online or on your favourite app, you can earn more UCount Rewards Points, which you can use to pay for anything from fuel to grocery vouchers, add to your savings, pay off your loan and more.

Your credit card can help you build or improve your credit score so that it’s easier and more affordable to access financing or loans in future.

There are different types of credit cards

Whether you’re considering applying for your first credit card or you’re looking for a different credit offering, knowing what you want from a credit card will help you choose the right one to suit your needs. Determine your reasons for getting a credit card by answering the following:

- Is this your first credit card? Perhaps you’re trying to establish or build on your credit score?

- Are you looking for more perks with a card that helps your money do more?

- Or do you need it as a standby as an affordable credit facility when you need quick access to money?

Knowing what you want your credit card to do for you will help you select one with features to suit your lifestyle at a fee that suits your pocket.

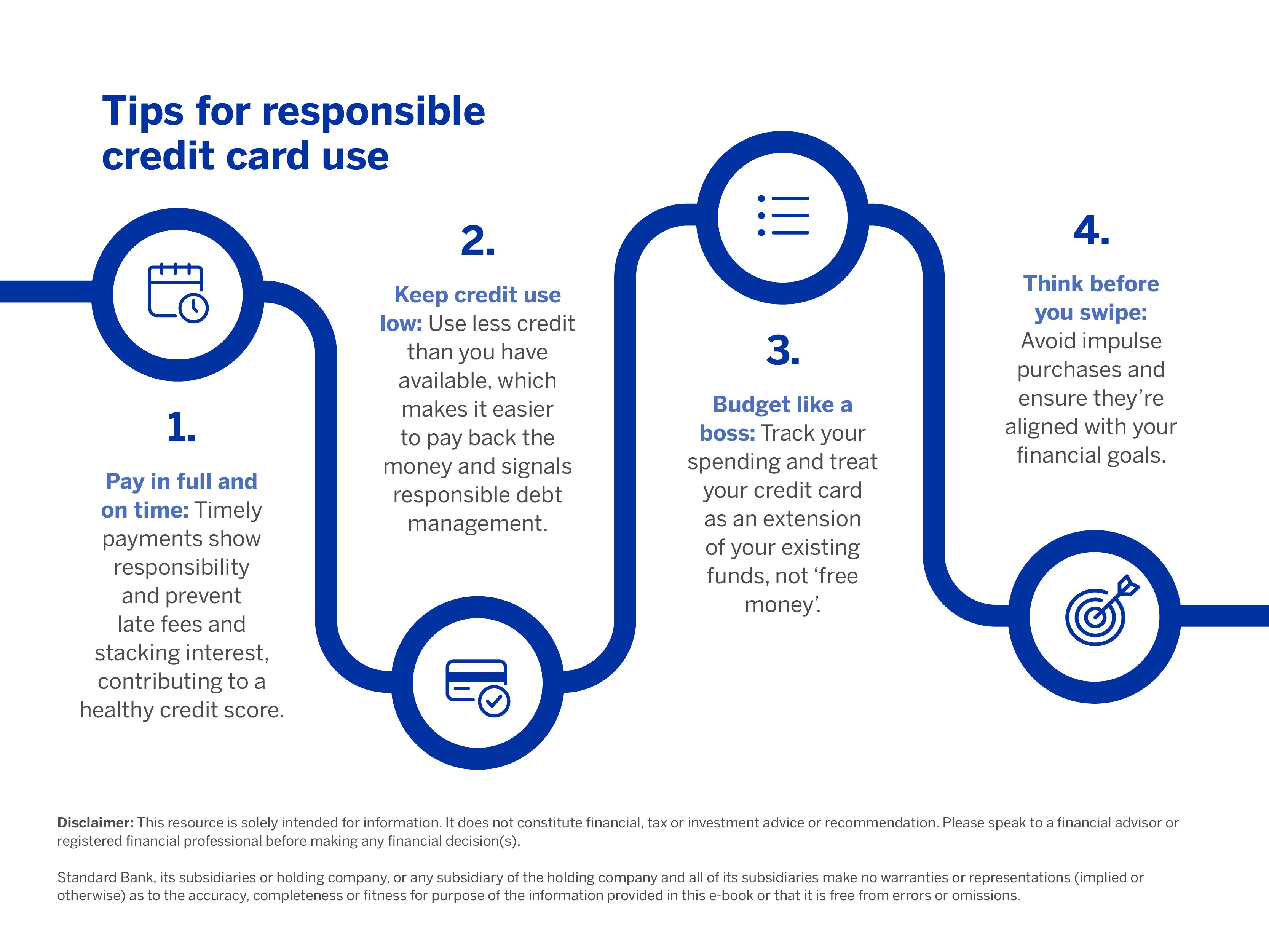

How to use a credit card wisely

- Each time you’re using your card, you’re using borrowed money to pay, which you must pay back. It’s easy to swipe, but it’s important to keep track of your purchases and stay on top of how much you owe the bank.

- Ensure you know what your interest rate and terms of accessing credit are. Only spend what you can afford to pay back.

- Always pay off your outstanding balance on time to avoid penalties. Try not to carry over outstanding balances from month to month as you’ll be charged interest on those amounts and it will become more expensive to pay off.

- To avoid accumulating too much debt and paying unnecessary costs, use it for the right reasons and only when you need to.

How to get a credit card

You need to be at least 18 and earn a minimum monthly income (required by the type of card). You can get an instant free quote online or sign in to your Internet Banking profile, complete a Call Me Back form and we’ll contact you about getting a card for your needs.

Terms and conditions apply.

Disclaimer: This article is for information purposes only and does not constitute financial, tax or investment advice. Readers are strongly encouraged to seek financial or legal advice before making any decisions based on the content.

Standard Bank, its subsidiaries or holding company, any subsidiary of the holding company and all of its subsidiaries, make no warranties or representations (implied or expressed) as to the accuracy, completeness, or suitability of the content of this article. The use of the article and any reliance on the content is at the reader’s risk.