When to use a credit card vs personal loan

There are times when you’ll need to unlock some extra cash, whether it’s for an emergency, a big expense or just enough to tide you over - and having access to credit can be a financial lifesaver. However, knowing how to use it is important for managing your money well and helping you best benefit from it.

A credit card and a personal loan are both good credit choices when it comes to financing your needs. However, they shouldn’t be used interchangeably, and deciding which type to use depends on your situation. So, how do you know? Here’s a look at how they compare and when it’s appropriate to use them.

Credit cards

When you apply for a credit card, you get instant access to money as often as you like, up to a certain amount. You pay off the outstanding balance or minimum monthly repayment each month and access the money again. It’s a form of revolving credit, which gives you the flexibility to access (up to a) specific amount at your discretion.The benefits are:

- You get a 55 day interest-free* window period to pay back the amount owed.

- Immediate access to money and good for everyday purchases.

- Lets you shop safely and conveniently in-store and online without having to carry cash.

- Helps you build and maintain a good credit score.

- Comes with additional travel, lifestyle and insurance benefits.

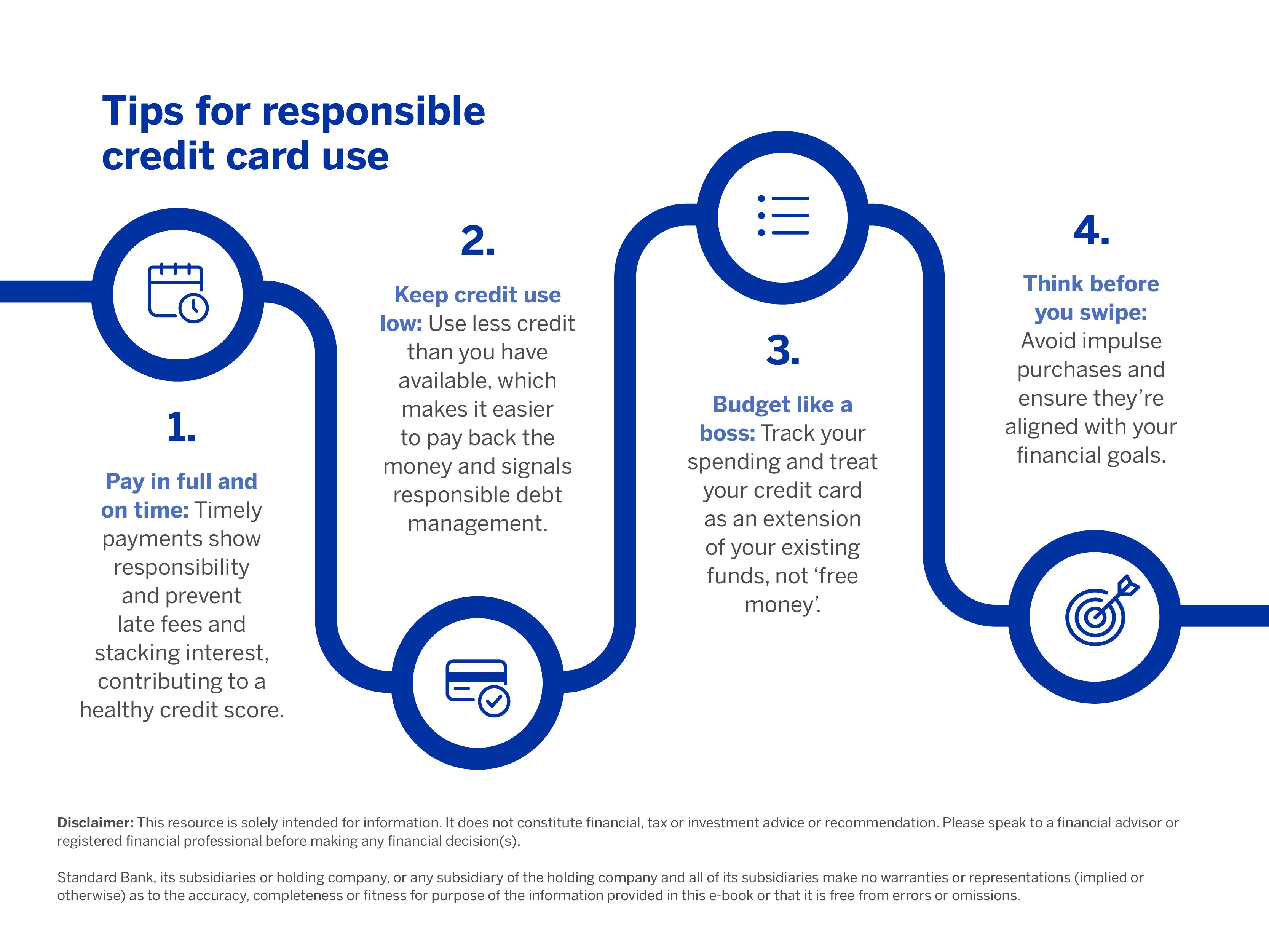

Note: It’s important to use a credit card responsibly without the temptation to overspend. Since it’s easy and convenient to use, you need to be vigilant in how much you’re borrowing and that you’re managing to pay it back so that you don’t fall into a debt trap.

Personal loans

When you apply for a personal loan, you get a fixed amount of money that you have to repay in instalments over a fixed period. The money can only be accessed once and the interest rate for paying back the loan amount is personalised depending on your credit score and at what rate the financial institution is willing to lend you the money.The benefits are:

- Good for large purchases and longer-term needs.

- A set instalment makes it easier to manage paying it off.

- You choose the repayment period (up to 84 months).

- Better credit score means a better interest rate.

- You can use your UCount Rewards to pay towards your monthly instalment.

When is it better to use one over the other?

Generally, your credit card is good for making smaller, day-to-day purchases and paying off smaller amounts faster. If you’re needing to make a big purchase, finance a large on-time expense, looking to consolidate your debt or needing more time to pay back the money - a personal loan is better suited. Use our personal loan calculator to see how much you qualify for and what your repayment terms will be.

Taking the time to determine which option is better for your need (and which payment terms are more appealing) will help you effectively manage your money and how you’ll be able to handle your debt. This will help save you money in the long run and get you closer to achieving your dreams.

Disclaimer: This article is for information purposes only and does not constitute financial, tax or investment advice. Readers are strongly encouraged to seek financial or legal advice before making any decisions based on the content.

Standard Bank, its subsidiaries or holding company, any subsidiary of the holding company and all of its subsidiaries, make no warranties or representations (implied or expressed) as to the accuracy, completeness, or suitability of the content of this article. The use of the article and any reliance on the content is at the reader’s risk.

Download our free e-book and learn more about credit and how to use it responsibly.