A guide to education savings

A quality education is a cornerstone for personal growth and future success, opening doors to incredible opportunities and empowering individuals to achieve their full potential. From foundational schooling to advanced tertiary studies, investing in education provides a powerful pathway to a fulfilling life.

While rising education costs are a reality, thoughtful planning and consistent effort can help you build a strategic education savings plan that makes securing this vital journey achievable.

How much do you need to save for an education?

This is a key question, and the answer varies widely based on factors such as the type of institution (public vs private and local vs international), location (especially if studying away from home) and the programme of study (some require costly equipment or curriculum fees). Future education inflation also significantly impacts projections. While exact figures are hard to predict, understand that costs can be substantial.

For example, a single year of private high school could be upwards of R250 000 and university upwards of R100 000. Looking ahead, annual costs for tertiary education could easily reach upwards of R250 000 for university or R600 000 for private high school by the time a child born today reaches that stage.

Estimating your goal

To help you get a clearer picture of how much you might need, begin by researching the current fees for the types of schools or universities you envision.

To estimate your education savings goal, start by researching current fees for your desired institutions. Crucially, factor in education inflation (typically 6‒8% annually) to project these costs into the future. Remember to include all associated expenses beyond tuition, such as textbooks, transport and living costs.

While this process can seem daunting, a qualified financial advisor can provide personalised projections. Ultimately, every rand saved reduces future borrowing.

Choosing the right tools to build an educational savings plan

There are several financial instruments available to help you save for a child's education, each offering unique features. The most effective approach often involves combining options, tailored to your personal financial situation, risk tolerance and timeline.

Here are some options to consider for building your education fund:

- Savings accounts

Savings accounts are a foundational tool for building your education fund, offering a secure and easily accessible place to deposit money. They are excellent for starting your savings journey, allowing you to consistently set aside funds and build initial capital.

Their low-risk nature ensures your principal is protected, making them ideal for short-term savings goals or as a holding place for funds you might need relatively soon for educational expenses.

Take the first step towards your education savings goal by using our Savings and Investment Product Filter to help you determine which savings account could best suit your needs.

- Tax-free savings account

A tax-free savings account (TFSA) can be a powerful tool for building an education fund as all investment growth, including interest, dividends and capital gains, is completely tax-free*. This means the money in the account can grow more efficiently towards the education goal.

You can contribute up to R46 000 annually, with a lifetime contribution limit of R500 000, but your growth is limitless. To leverage this growth potential and the benefits of compound interest, it's best to keep your funds invested for the long-term, resisting the urge to make withdrawals.

While you can open a TFSA in your child's name, it's important to note that each individual is only allowed one TFSA in their lifetime. This means any contributions made to a TFSA opened for your child will count towards their personal lifetime limit.

- Medium- to long-term investments

Medium- to long-term investments, such as unit trusts and exchange-traded funds (ETF), are particularly well-suited for education savings because they offer the potential for significant growth that can outpace inflation over many years.

By investing over a longer period, you allow your capital to benefit from compounding, meaning your returns also start earning returns. While all investments carry some level of risk, the longer time horizon typically associated with education savings allows for a more diversified and potentially lower-risk investment approach.

Explore our range of investment solutions to help you create an education fund.

What are your options for saving for education?

By starting early, you leverage the power of compounding, allowing even modest contributions to grow significantly. This proactive approach helps manage rising education costs, reduces the need for future student debt and provides financial security, ensuring preparedness for educational milestones.

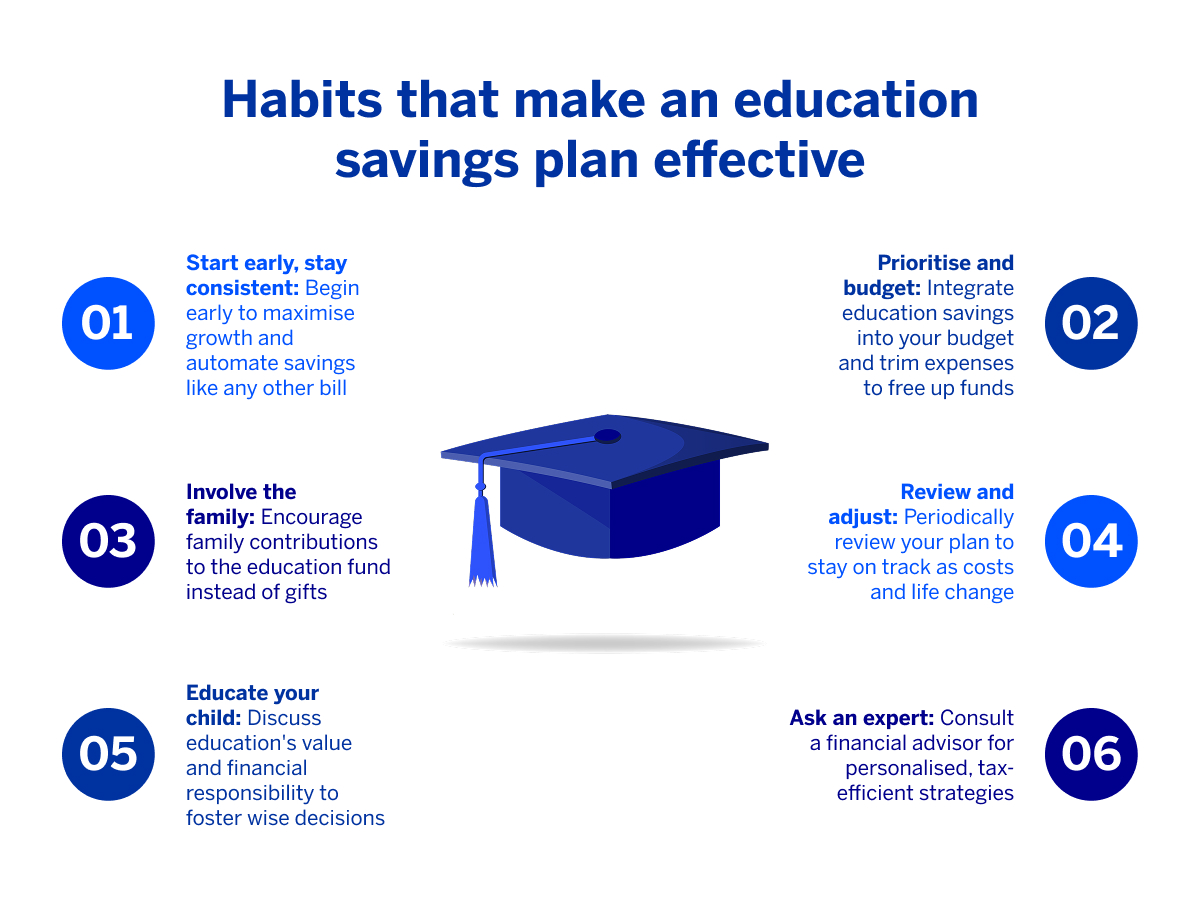

Let's consider the overarching strategies that can make your education savings plan effective:

*Terms and conditions apply

Disclaimer: This article is solely intended for information. It does not constitute financial, tax or investment advice or recommendation. Please speak to a financial advisor or registered financial professional before making any financial decision(s).

Standard Bank, its subsidiaries or holding company, or any subsidiary of the holding company and all of its subsidiaries make no warranties or representations (implied or otherwise) as to the accuracy, completeness or fitness for purpose of the information provided in this article or that it is free from errors or omissions.