What you need to know about personal loans

Whether you’re upgrading your home, booking a dream holiday, or covering an emergency, a personal loan can help turn plans into reality. But before you apply, it’s worth knowing exactly how they work, from the costs and requirements to the responsibilities that come with them.

Used wisely, a personal loan can be a smart way to manage bigger expenses without draining your savings. The key is making sure it’s the right fit for your needs, your budget, and your long-term financial goals.

Understanding how a personal loan application works

When you borrow money in the form of a personal loan, you pay it back in monthly instalments over a certain period. How much interest you’re paying and how much time you have to pay back the loan differ depending on the amount you’re borrowing and in what timeframe you’re comfortable repaying it.

Every personal loan application is assessed on an individual basis and approved or denied accordingly, with the loan amount and repayment terms based on the following:

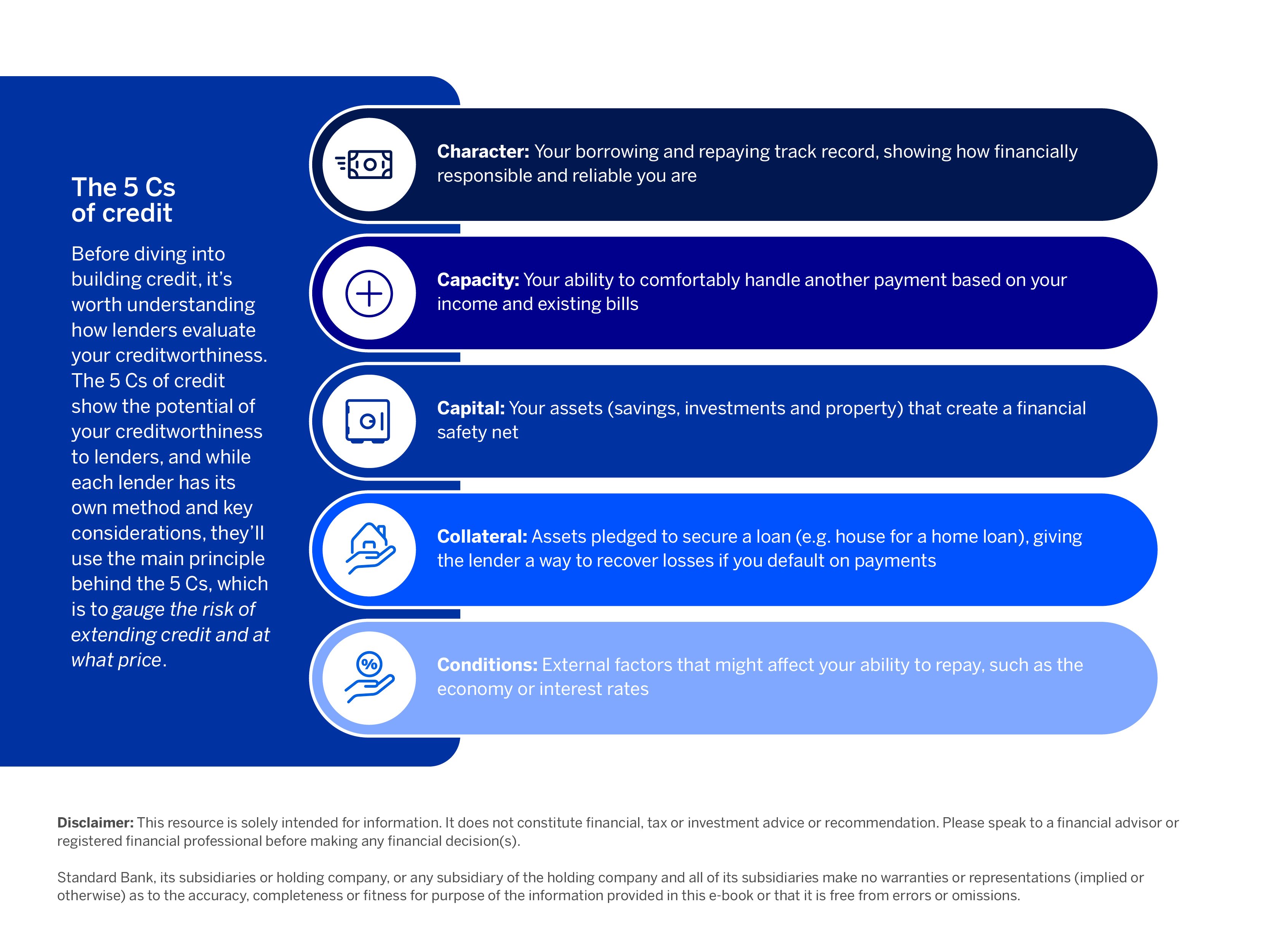

- Your credit score: Evaluating your ‘creditworthiness’ to see how much debt you have and how you’ve handled debt and repayments in the past.

- Your income: How much you earn will determine how much credit you can take on. Do you make enough money to repay your loan and still have enough left for other expenses?

- Requirements set out by the National Credit Act: Our interest rates are personalised as per the NCA regulation. The good news is that a good credit score and your risk profile could get you a better interest rate.

Agreeing to the terms

Remember to consider all your borrowing options and whether the loan type you’re applying for suits your needs and financial capabilities. Also note that the amount of interest and the repayment time you’re agreeing to will impact the overall cost of the loan. Even though a lower monthly instalment might initially seem cheaper, paying it over a longer period could add up to cost you more in the end.

Use our personal loan calculators to get an estimate of how much you qualify for and what your monthly repayments would be. You can also get an indication of how changes in term, interest rates, and missed and early payments affect your loan.

- You can apply online or on our Banking App.

- You can apply via Cellphone Banking through USSD by dialing *120*5626.

- You can apply by dialling 0860 123 000 and then choosing option 5.

- You can visit your nearest branch to apply for a loan.

Yes, your loan includes credit life insurance.

- You will receive funds immediately* if you're already a Standard Bank customer who applied via Online Banking or our Banking App.

*T&Cs apply. - You'll receive funds within 1 to 2 working days if you are an existing Standard Bank customer who applied in-branch or if you applied by selecting the CALL ME BACK options on our website.

- You will receive funds within 2 to 3 working days if you don't bank with us (pending verification of outstanding conditions, e.g. confirmation of income).

- Yes, we offer credit limit increases on our Revolving Loan and Overdrafts.

- You may increase your limit via our Banking App, Online Banking, or on our website.

- You can also increase your limit by visiting your nearest Standard Bank branch.

- Credit limit increases are subject to affordability and good credit standing.

- As part of the loan process, we’ll arrange a debit order to deduct payments on a date that aligns with your salary date or a date of your preference.

- Additional payments can be made into the loan account which will assist in reducing your loan balance.

- You need to earn R3 000 per month for a Term Loan.

- You need to earn R8 000 per month for a Revolving Loan and Overdraft.

- If you have applied via Online Banking, our Banking App, our website, in-branch or Cellphone Banking, you will know immediately*if your loan has been approved or declined.

- You can request a settlement letter at your nearest branch, banker, or via voice branch.

- You can view your balances on Online Banking, our Banking App, in-branch or via or voice branch.

- If your account has been handed over to lawyers, you may visit your nearest branch or contact us on 0860 123 000.

- If you have a Term Loan account, it will automatically close once paid up or settled.

- Your Revolving Credit Plan or Overdraft can be closed in-branch, through your banker, or you can contact us directly on 0860 123 000.

Disclaimer: This article is for information purposes only and does not constitute financial, tax or investment advice. Readers are strongly encouraged to seek financial or legal advice before making any decisions based on the content.

Standard Bank, its subsidiaries or holding company, any subsidiary of the holding company and all of its subsidiaries, make no warranties or representations (implied or expressed) as to the accuracy, completeness, or suitability of the content of this article. The use of the article and any reliance on the content is at the reader’s risk.

Download our free practical guide to understanding credit and managing your debt.