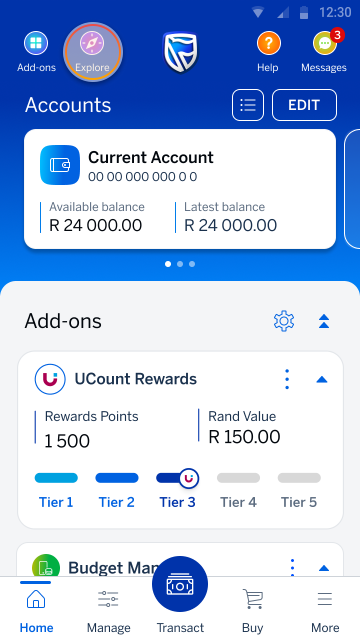

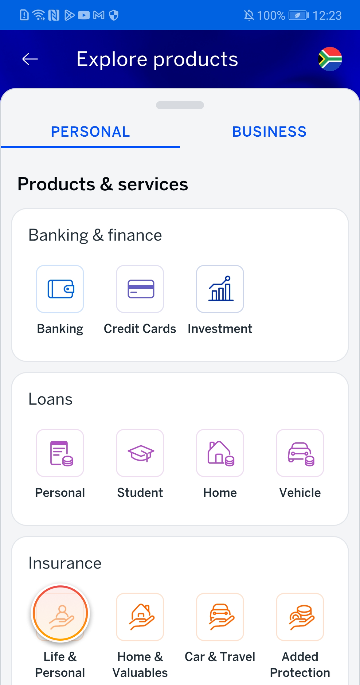

Getting to know the app

15 Nov 2023

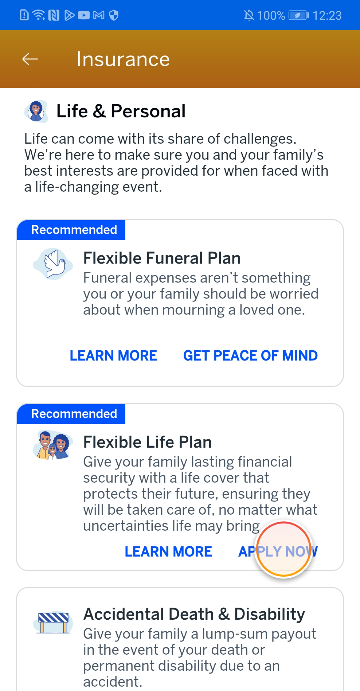

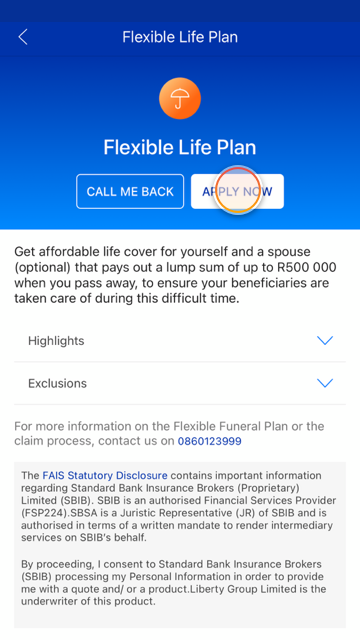

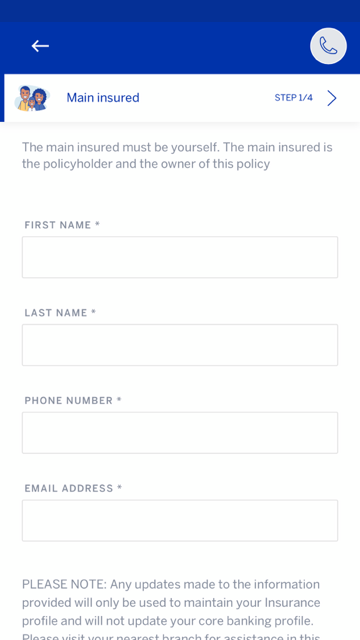

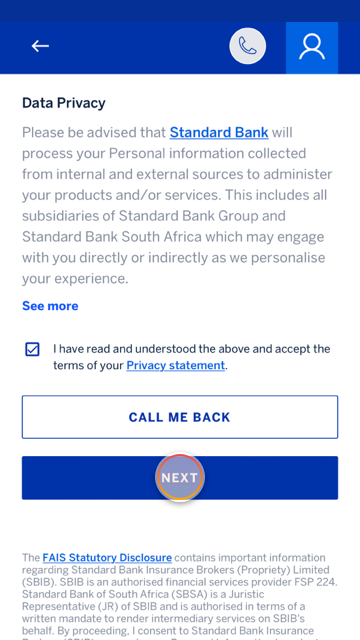

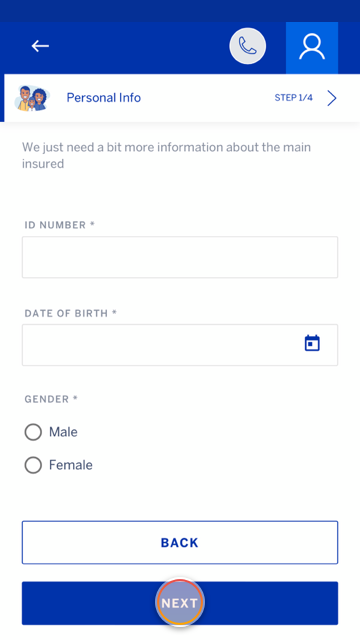

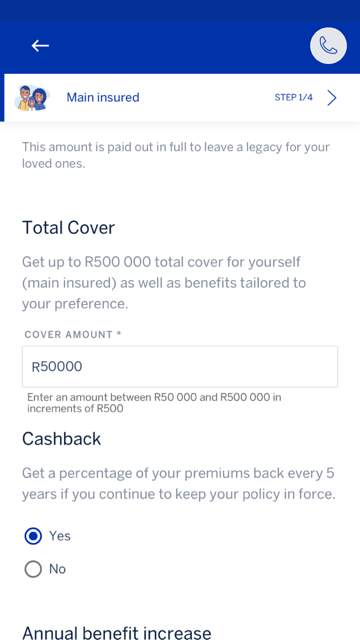

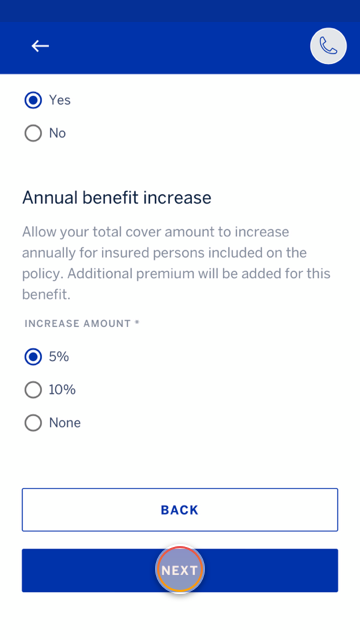

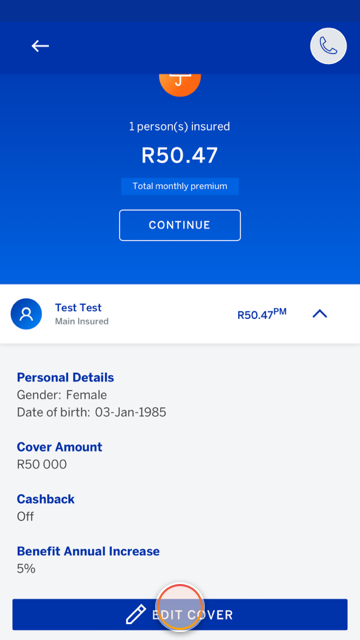

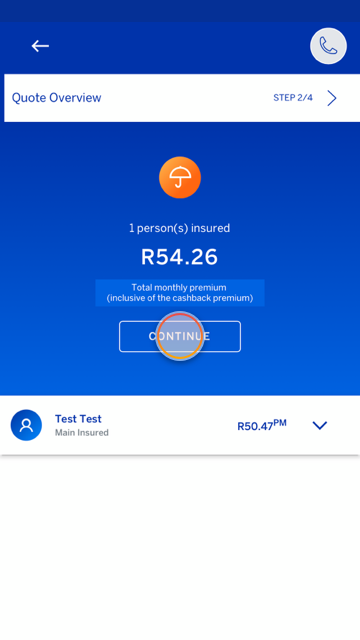

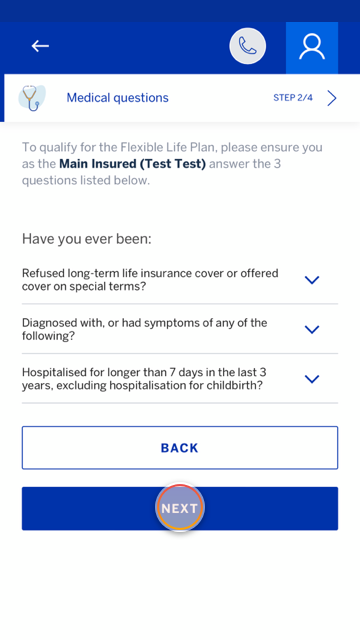

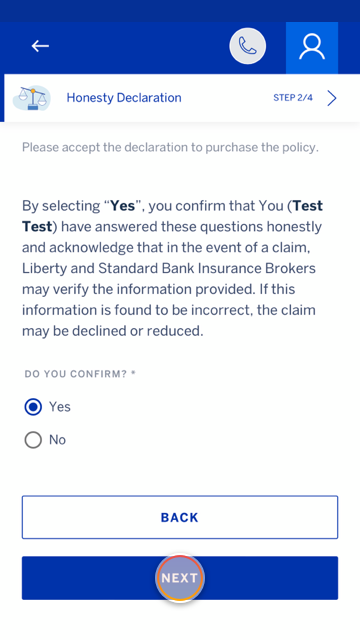

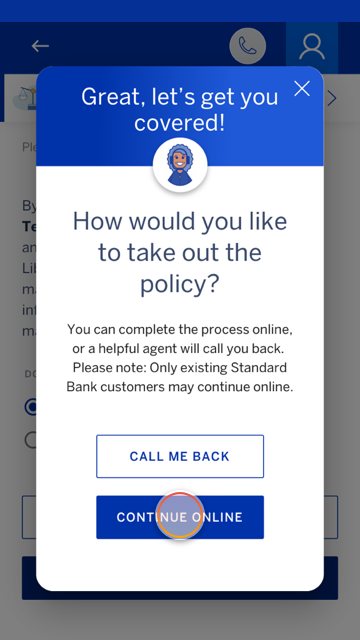

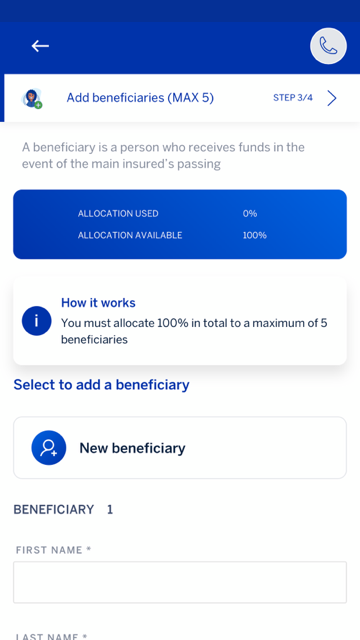

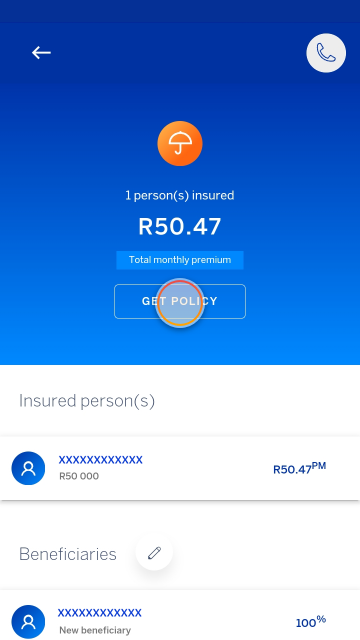

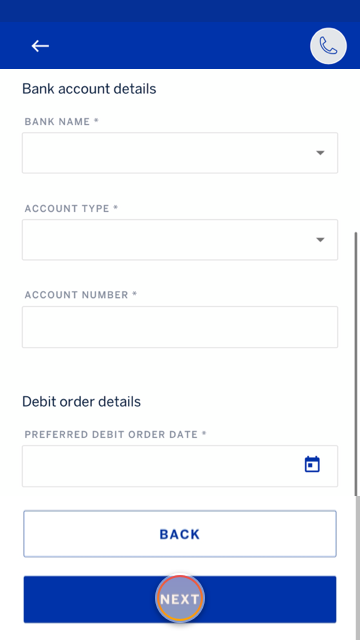

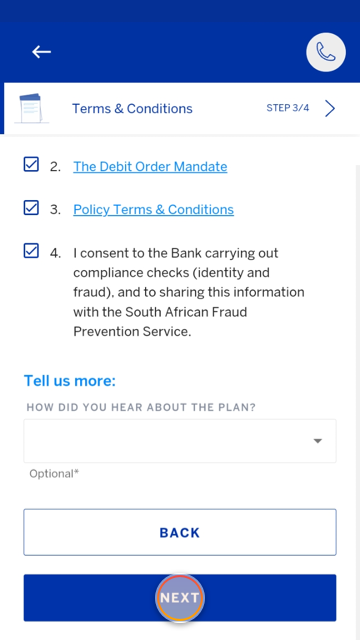

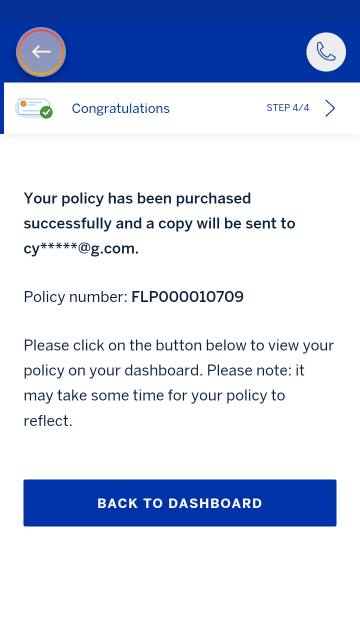

Get a Flexible LifePlan cover

Enjoy a customisable life policy that can be tailored to your budget and preferences

More things you can do on the app