5 Steps to a better credit score

Dreaming of a new car, home ownership or simply more financial freedom? A strong credit score is vital for achieving such goals, opening doors to better interest rates on loans, credit cards and even lower insurance premiums.

When you apply for a loan (or credit), lenders need to understand your financial habits and assess your ability to repay the debt on time. A credit score is a key indicator of your financial responsibility and what your financial health looks like.

A higher score signals trustworthiness and reduces their risk of lending. However, what if you have a low(er) score? The good news is your score isn’t fixed, and you can take steps to change and improve it. Here’s how:

1. Pay your bills on time, every time

On-time payments are essential for a strong credit score as they demonstrate your reliability to lenders. Late or missed payments are major red flags. A great way to protect your score is by doing the following:

- Set up automatic payments from our Banking App so you don’t have to remember to do it every month.

- If you do fall behind, get back on track as soon as possible. Even one late payment can negatively impact your score, but consistent on-time payments going forward will help rebuild it.

- Focus on paying your credit card bills and loan payments before other discretionary expenses, stay on top of all your payments and see where you can cut back by creating and sticking to a budget.

2. Tackle your debt (strategically)

High outstanding debt weighs down your credit score, but actively paying it off signals responsible financial management. You can tackle your debt by doing the following:

- Choose a debt repayment plan, such as the debt snowball or avalanche method.

- Don’t just pay the minimum monthly instalment; this racks up more interest, which means it becomes more expensive to pay off.

- If you cut back on spending, you can free up cash to use for extra payments. • If you're struggling to make payments, contact your creditors to see whether you can negotiate different repayment plans.

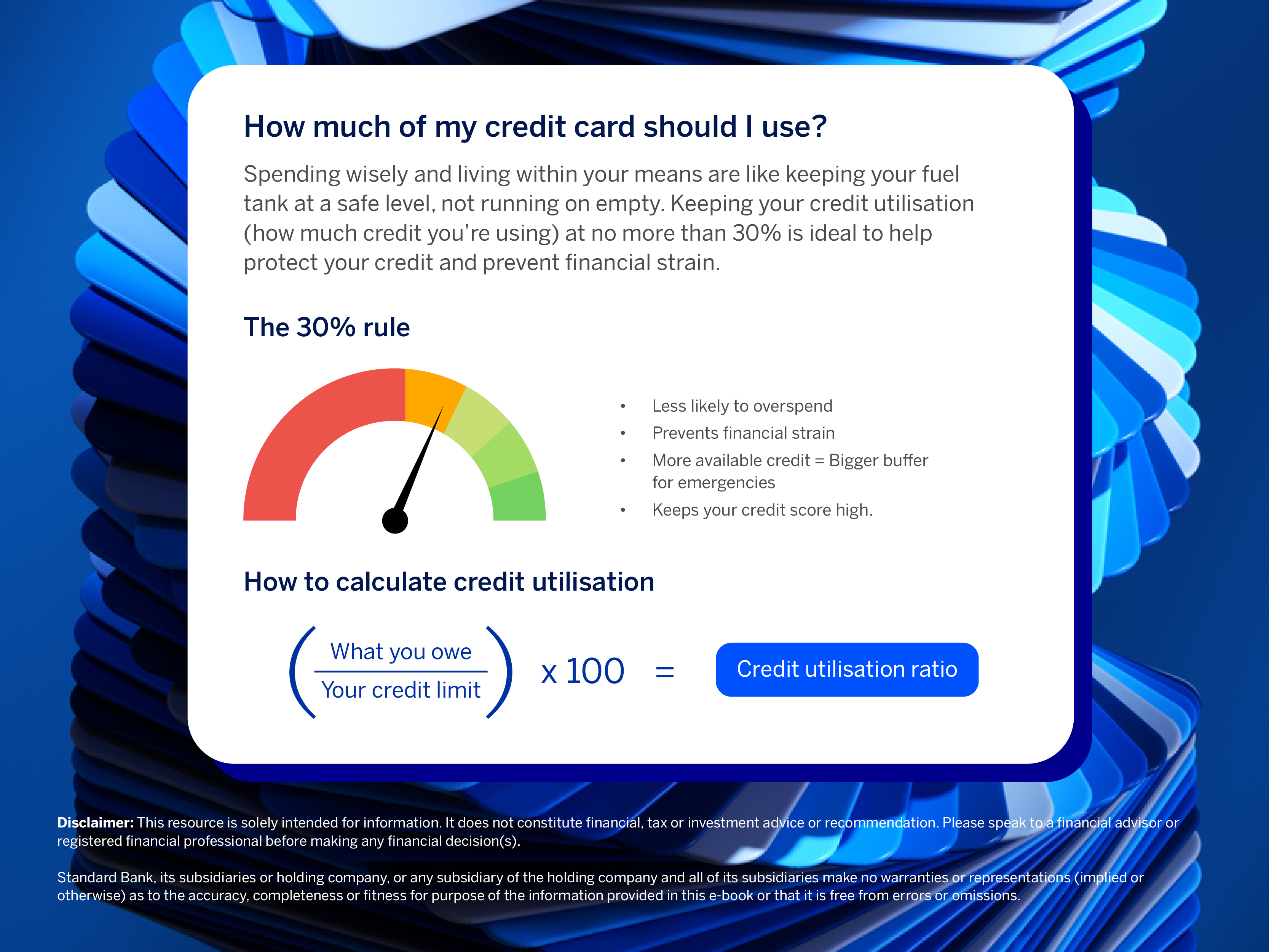

3. Keep what you’re using low

The amount of credit you’re using in relation to how much you have available is called credit utilisation, and it can significantly impact your score. Lenders favour low credit utilisation, so strive to keep your outstanding balances low so that you can comfortably repay them. Try to avoid spending more just because you have access to more.

|

TOP TIP Instead of waiting until the end of the month to pay your credit card bill, consider making multiple payments throughout the month to keep your credit utilisation low. |

4. Lose what you don’t use

The less available credit you have against your name, the lower your risk. Creditors assess the full facility of your credit agreements, taking them into account even if they aren’t being used.

Identify unused accounts, close newer ones first and consider the impact of how much credit you are using.

5. Know your credit rating

Knowing your credit rating allows you to track your progress and stay on top of your credit health. It can also help you identify any errors that may be negatively impacting your score or check for fraud.

Download credit score checklist

Use the Credit Score add-on on our Banking App to quickly and easily check your credit score for free and get monthly updates without affecting your credit record.

Terms and conditions apply.

Disclaimer: This article is for information purposes only and does not constitute financial, tax or investment advice. Readers are strongly encouraged to seek financial or legal advice before making any decisions based on the content.

Standard Bank, its subsidiaries or holding company, any subsidiary of the holding company and all of its subsidiaries, make no warranties or representations (implied or expressed) as to the accuracy, completeness, or suitability of the content of this article. The use of the article and any reliance on the content is at the reader’s risk.