Tips for buying your first car

Buying your first car is an exciting step towards freedom and a significant decision that will most probably impact your financial future.

From choosing the right make and model to understanding finance options, there are a number of factors to consider.

Before running to your nearest car dealership, here are 5 budgeting and finance tips to help your first-time car-buying experience run as seamlessly and stress-free as possible.

Consider the real cost of buying a car

When you consider the initial cost of buying your car, it usually includes the deposit required, the monthly instalment, the car registration and even the roadworthy certificate.

However, the cost of a car not only includes the purchase price elements. Here are other costs that you need to factor into your budget before driving off the showroom floor with your new ride:

- Fuel consumption and the cost of fuel

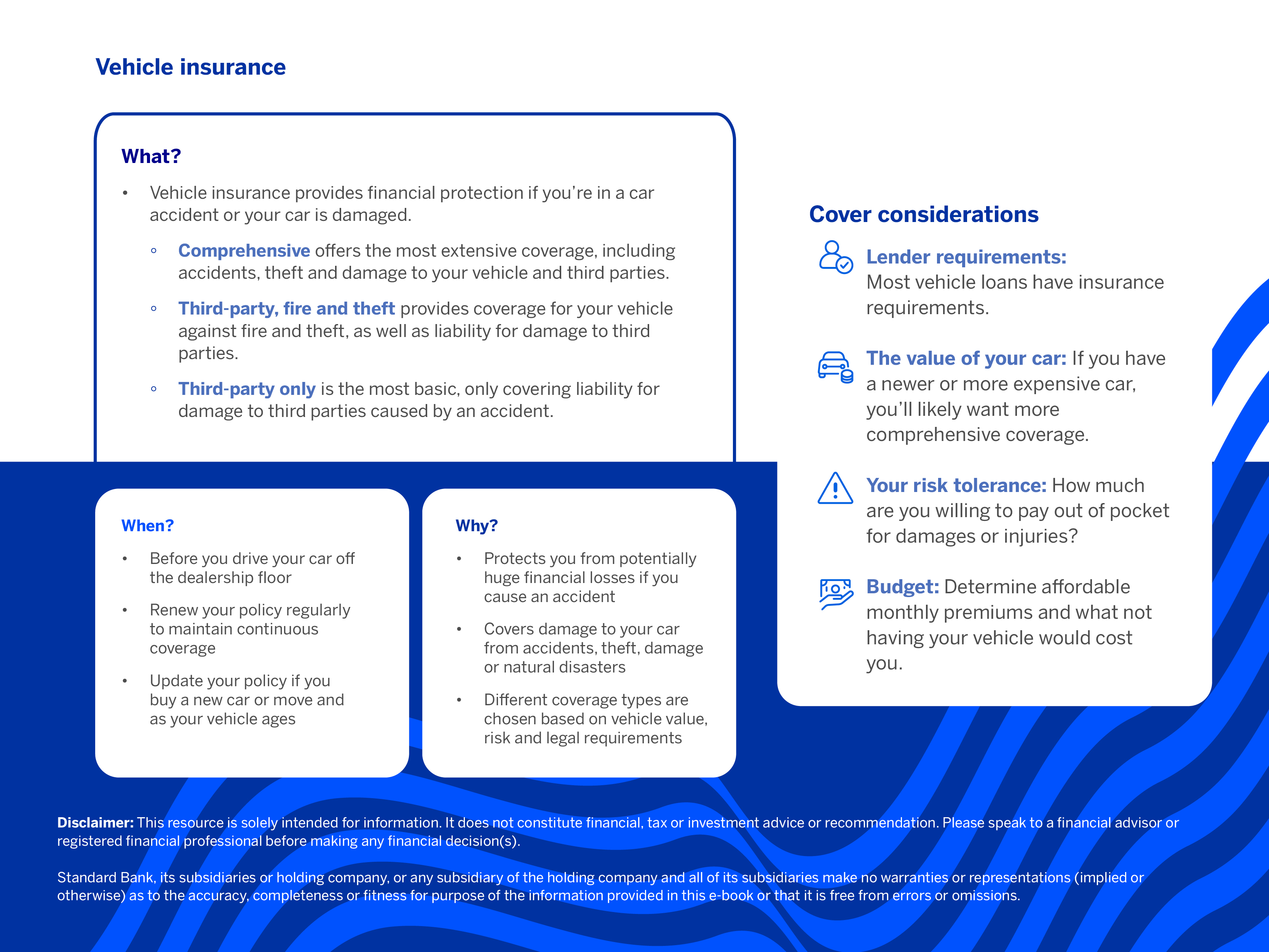

- Car insurance

- Regular services and repairs

- Wheel balancing and alignment

- Vehicle licence

- Tyre replacement

- Regular cleaning

It’s recommended that the total cost of the car, including monthly instalments, should not exceed 30% of your annual gross salary (monthly salary before deductions x12), and this percentage may be lower if you have other debts.

Stick to your budget

It’s easy to get swept up in the excitement of buying your first car, especially when you’re in a showroom surrounded by sleek designs and state-of-the-art features. The thrill of a test drive can also make it tempting to stretch your budget beyond its limits.

While it is natural to feel ‘seriously interested’ in a particular model, it is essential to keep a practical mindset and stick to your budget:

- Determine your budget beforehand and stick to it.

- Research the make and model of the car you want and compare prices from different dealerships.

- Avoid impulse buying and take time to consider your options before making a decision.

- Negotiate with the dealership to get the best deal possible within your budget.

This will help you make a sound and sustainable investment that aligns with your financial goals and lifestyle needs for the long term.

Do your homework

Buying your first car is a significant financial commitment, which is why you should aim to understand the purchasing process, the responsibilities of car ownership, the available features and the right dealership to help you make the right decision.

- Seek advice from friends or family who have experienced buying and owning vehicles, and use their knowledge to help you make a decision.

- Use online research to understand the make and model of your desired car, including consumer complaints, recalls or safety-related issues.

- Make a list of the essential features you need and stick to it. This includes seating configuration, transmission type, safety features, fuel consumption and maintenance costs.

- If you’re buying a pre-owned car, ask for details on the car, including how old the car is, whether it has a maintenance booklet or accident history and what its mileage is. It’s also a good idea to ask about the market cost of parts to service and what its servicing history is.

Choose your financing wisely

Did you know there’s more than one way to finance a car? Before committing financially, it is essential to weigh up your options and choose the finance solution that best suits your needs:

- With an instalment sale agreement, you borrow money from a bank or dealership to purchase a car. You then pay back the loan (plus interest) in fixed monthly instalments over a set period (typically 72 months). Once you’ve made all the payments and the final amount is settled, the car is yours.

If you choose an instalment sale for your car, you also have the option to add a balloon payment. This means the loan you take out from a bank or dealership doesn’t cover the entire purchase price. Instead, you finance a portion of the car’s value, and the remaining balance is due as a lump sum at the end of the loan term. Think of it as a large ‘final’ payment before you own the car. - Unlike an instalment sale, a financial lease is more like a long-term rental agreement. You essentially ‘borrow’ the car from a financial institution for a fixed period (usually 60 months) and make monthly payments to cover the car’s depreciation and financing fee. At the end of the lease, you can either return the car, buy the car at a pre-determined price or extend the lease for an additional few months.

Make sure you’re insured

Once you've found your dream car and your financing is approved, it's crucial to act quickly to get insurance in place. Before making a decision, it's essential to get as many quotes as possible and understand what you're paying for.

Without insurance, you could face significant financial losses if an accident occurs. Therefore, it's vital to ensure that you have adequate coverage before taking possession of your new car. By being proactive and obtaining insurance early on, you can enjoy peace of mind while driving your new vehicle.

Need help to finance your first car?

Use our vehicle finance calculator to estimate what you can afford and what your monthly payments could be.

Disclaimer: This article is for information purposes only and does not constitute financial, tax or investment advice. Readers are strongly encouraged to seek financial or legal advice before making any decisions based on the content. Standard Bank, its subsidiaries or holding company, any subsidiary of the holding company and all of its subsidiaries, make no warranties or representations (implied or expressed) as to the accuracy, completeness, or suitability of the content of this article. The use of the article and any reliance on the content is at the reader’s risk.