Is your life cover keeping up with your life? When to update your protection

Insurance isn’t something you set up once and forget. As your life changes and your lifestyle evolves, so should your life insurance. Milestones such as marriage, career changes or buying a home can all affect your financial needs and the level of protection your loved ones may rely on in the future.

It’s worth checking in regularly to make sure your cover still fits your lifestyle, income and responsibilities. Reviewing your life cover isn’t about spending more; it’s about staying protected as your circumstances change. The right cover at the right time helps you manage risk, protect your loved ones and maintain peace of mind.

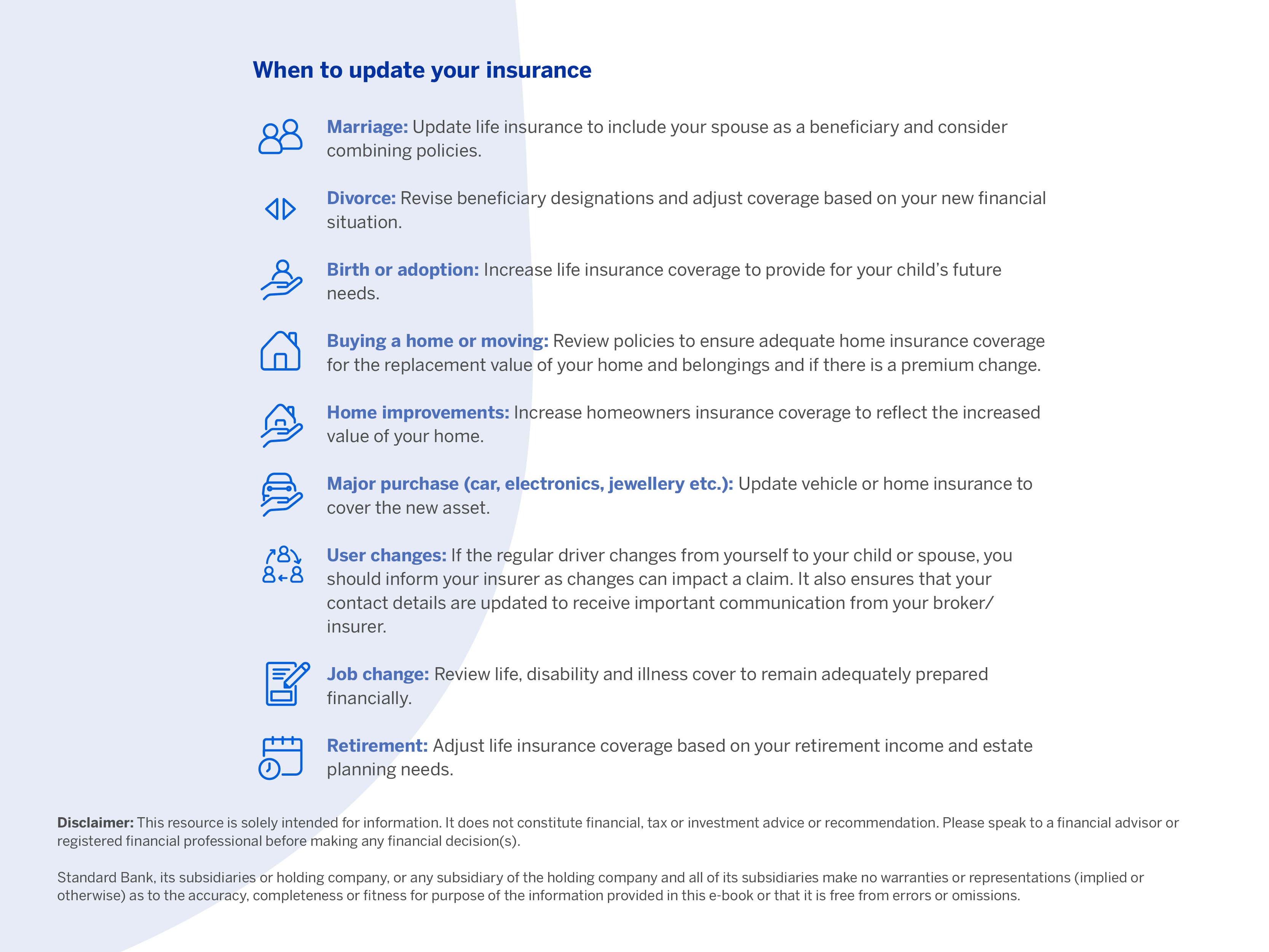

Here’s when and why you should reassess your cover:

When you start working

At this point, consider life cover that protects your dependants should something happen to you. Even if you don’t have dependants yet, choose an option that lets you increase your life cover later without medical underwriting.

When you change jobs

When you change jobs, it's also a crucial time to review your life cover. Your new employer may offer different group life benefits or none at all, which could affect the overall protection for your loved ones.

Ensure your personal life cover remains adequate to meet your family's financial needs, regardless of changes in employer-provided benefits. In the unfortunate event of you losing your employment, it’s tempting to cancel policies to cut costs, but doing so may leave your loved ones vulnerable.

Avoid the knee-jerk reaction of cancelling your life cover. This would leave your family extremely vulnerable financially should something happen to you. In addition, you may not be able to get cover at the same premium again after you have cancelled your cover, particularly if your health status has changed.

When you get married or enter a long-term partnership

When your financial life becomes shared, it’s a good time to review your life cover amount to ensure your partner can manage living expenses or debt repayments if something happens to you. This is also an ideal time to sit down and discuss your financial planning.

NB: Remember to update your Will and the beneficiary details on all your life insurance policies to include your spouse or partner.

You’ve just bought a house

Buying property is one of the most significant financial commitments you’ll ever make and raises various financial implications, such as property maintenance expenses, bond repayments, water and lights bills, levies, and renovation and construction costs.

When you have children

Reassess your life cover to provide for your children and particularly for their education. It may also be advisable to include a testamentary trust. Should you pass away, the proceeds of your policies or assets can be paid into the trust until your children become adults. You also need to update your life insurance policy beneficiary nomination forms accordingly.

When one partner stops working to raise children

This will change your family budget and lifestyle. When reviewing your finances, ensure that the stay-at-home parent has life cover. Although the parent may not be earning an income, they are the primary caregiver, and this would become a cost to the family if the parent was no longer able to care for the children.

You get divorced (or leave a long-term partnership)

Divorce can significantly affect your finances. Update the beneficiaries of your life policies if you no longer want your ex-spouse to be named as a beneficiary. If you were covered on your spouse’s life insurance policies, you’ll need to apply for your own separate policies.

You retire

It’s important to undergo a full financial assessment and have a proper plan in place for retirement. A full review of your life insurance is important as your needs will change significantly. Assess how much life cover you still require. If your children are no longer financial dependants, the need for cover may be reduced, but you still must consider factors such as spousal support and estate duty.

If your partner can’t afford these costs when you’re gone, it’s crucial to ensure that your life cover amount is enough to cover these expenses over and above the living expenses that your family will be left with.

*Terms and conditions apply

Disclaimer: This article is solely intended for information. It does not constitute financial, tax or investment advice or recommendation. Please speak to a financial advisor or registered financial professional before making any financial decision(s).

Standard Bank, its subsidiaries or holding company, or any subsidiary of the holding company and all of its subsidiaries make no warranties or representations (implied or otherwise) as to the accuracy, completeness or fitness for purpose of the information provided in this article or that it is free from errors or omissions.

Protect you future

Download the free Insurance essentials e-book and start a secure future.