How conscious spending can help you grow wealth

Building wealth isn’t only about how you save; it’s about how you spend and knowing when it’s right or not. Since your spending habits influence how much you can save, it’s important to be mindful of your spending.

That doesn’t mean you must never spend (or occasionally splurge) on anything; it means cultivating a positive relationship with your finances and being purposeful about how you use it and how it can help you achieve your goals.

What is conscious spending?

To be financially healthy, you need to be in control of your money and confident in your money decisions. When you are consciously spending, you are aligning what you spend your money on with your interests and making money decisions based on your priorities and goals, for example, focusing your efforts on paying your bills, paying yourself and saving for retirement. It also includes setting money aside that you can use to spend on whatever you want.

Furthermore, being mindful requires being more aware and critical about the things you spend your money on. Is what you’re buying making you happy? Is it what you need or even want? Is it good for you? What effect does buying this have on others and the environment?

Why practise conscious spending?

Being mindful about your spending can help you do the following:

- Control your finances: when you know what your money is doing and where it is going, you can see where you need to make changes, which could lead to paying less and saving more.

- Stress less: being aware of your spending habits could help you better manage your money and perhaps break the habit that’s leaving you living paycheque to paycheque.

- Reach your financial goals: taking the time to think about what you’re spending money on instead of blindly doing so could mean less wasteful spending and freeing up more cash or directing that money towards your goals. You might be able to put that (extra) money into savings or investments.

How to be a conscious spender

- Set spending criteria for yourself

There are the general questions you should ask yourself, such as, do I really need this; can I really afford it; can I get it at a better price? But also ask yourself, “Can I do without it? Is this helping me get closer to my financial goal? Is it helping or hurting me or the planet? Do I have something like this already? How will this improve my life?”

- Make a list of what you want

Knowing what you really want will help you prioritise your purchases over getting caught up in frivolous spending. It will also help you look for good deals and help you realise whether this is something that will serve you or you should look for something different. - Take your time

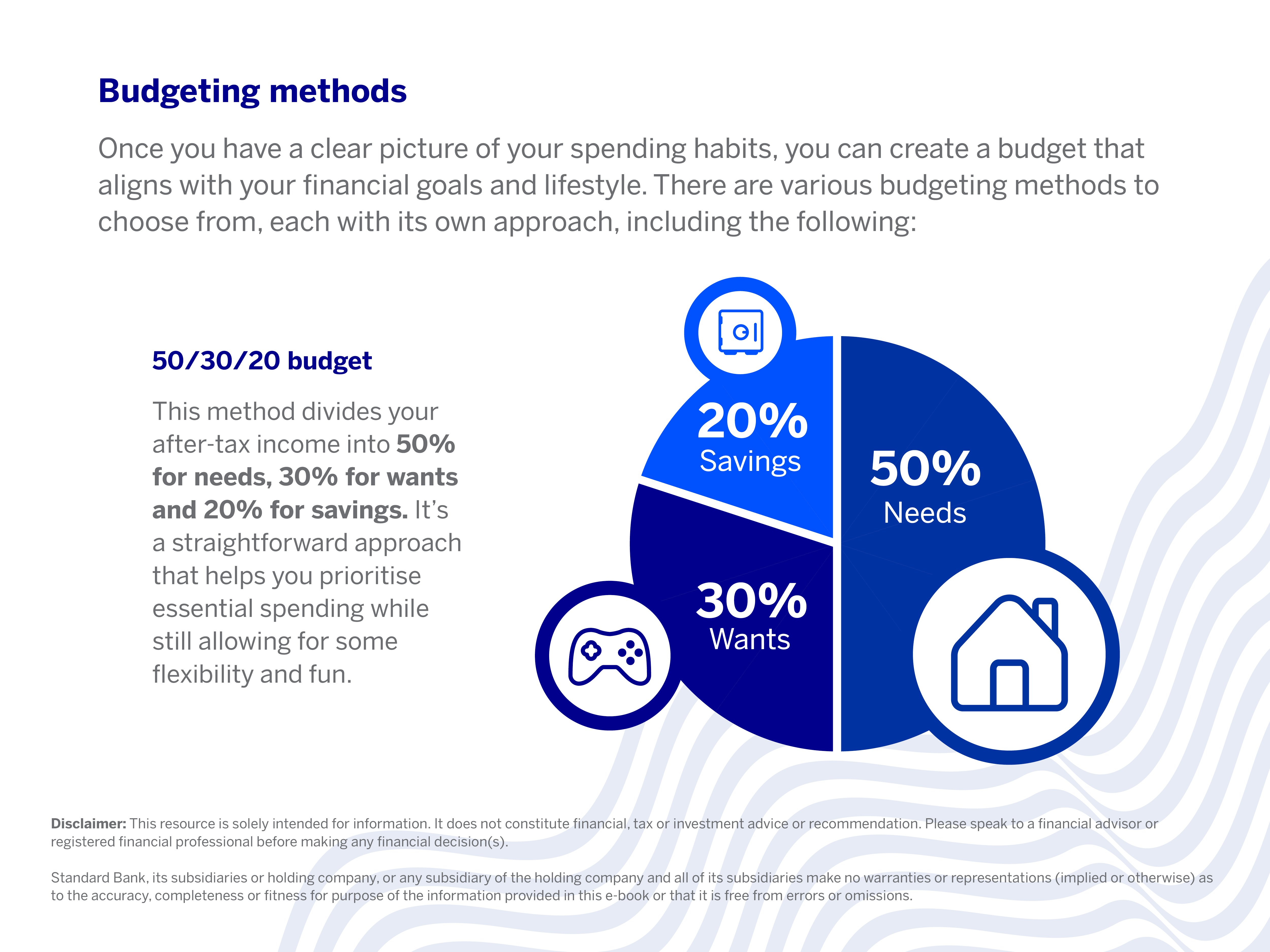

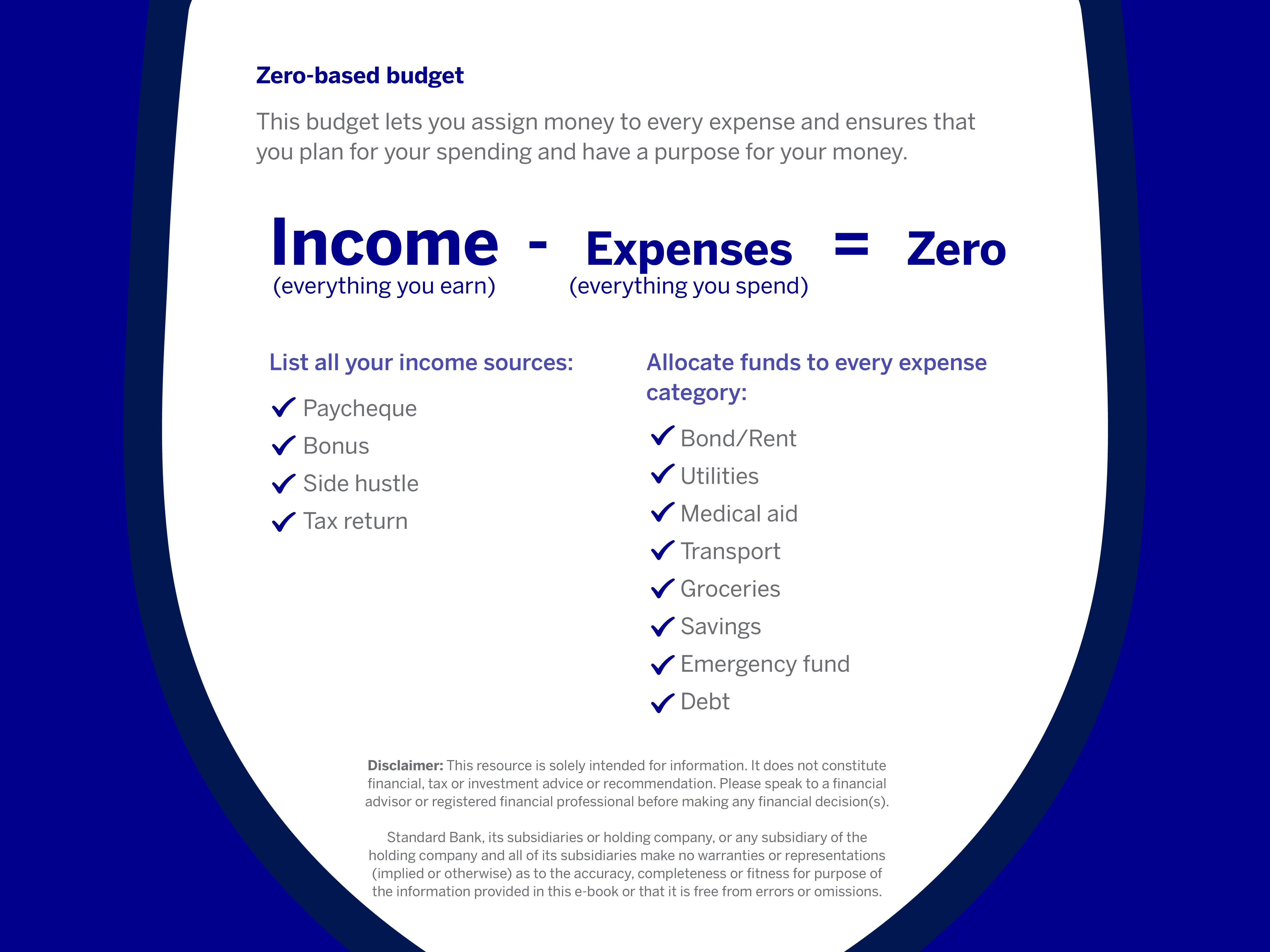

Stop buying on impulse. Practise waiting a bit longer before committing to a purchase. For example, if you see an item of clothing you like and it fits all the other criteria, decide to buy it at the end of the month. That way, the impulse might subside in a few hours/days, and if it’s still important for you to have it at the end of the month, you’ll know it was a worthwhile buy. - Plan a budget

Knowing exactly how much money is coming in and going out, and for what, puts you in a position where you can assign money to spending. Knowing that you have money that you can use for whatever you want means your spending doesn’t sneak up on you and you don’t have to feel guilty about purchases. Spending less on what you don’t need means having more to spend on what you really want.

Conscious spending is simply about choosing with intention: saving money, reducing stress, and making room for what truly matters to you. If you want even more practical ways to boost your savings, download our free savings e-book for quick, easy strategies you can start using today.

Disclaimer: This article is for information purposes only and does not constitute financial, tax or investment advice. Readers are strongly encouraged to seek financial or legal advice before making any decisions based on the content.

Standard Bank, its subsidiaries or holding company, any subsidiary of the holding company and all of its subsidiaries, make no warranties or representations (implied or expressed) as to the accuracy, completeness, or suitability of the content of this article. The use of the article and any reliance on the content is at the reader’s risk.