7 Debt management tips

To build wealth and focus on important financial goals, you need to trim down and ultimately eliminate debt. These debt management tips will help you stay in control of your money.

Developing the discipline and motivation to get out of debt will enable you to focus on becoming financially secure. Debt keeps you from making the most of your money, which is why it is critical to know how to manage it.

Debt management tips

Here are some pointers to help you stay on track:

- How bad debt negatively impacts you

- How your credit score affects you

- When debt is good

- Effective debt management tips

1. How bad debt negatively impacts you

The more money you owe, the less likely it is that you will be able to repay your debt. Too much borrowing can quickly trap you in a debt spiral that is difficult to escape from.

Skipping payments or paying your credit card late will negatively impact your credit score, making it unlikely that you will get approval for big ticket items like a home loan. Moreover, a bad credit record can have a negative impact on your professional life, making it difficult for you to find a job.

What is a credit score?

- Your Credit Bureau Score is calculated through a formula determining your ability to pay your bills, the amount of debt you carry and how it compares with other borrowers.

- This single number on your credit report indicates your capacity to manage existing credit. Generally, the higher your score, the better.

Download credit score checklist

2. How your credit score affects you

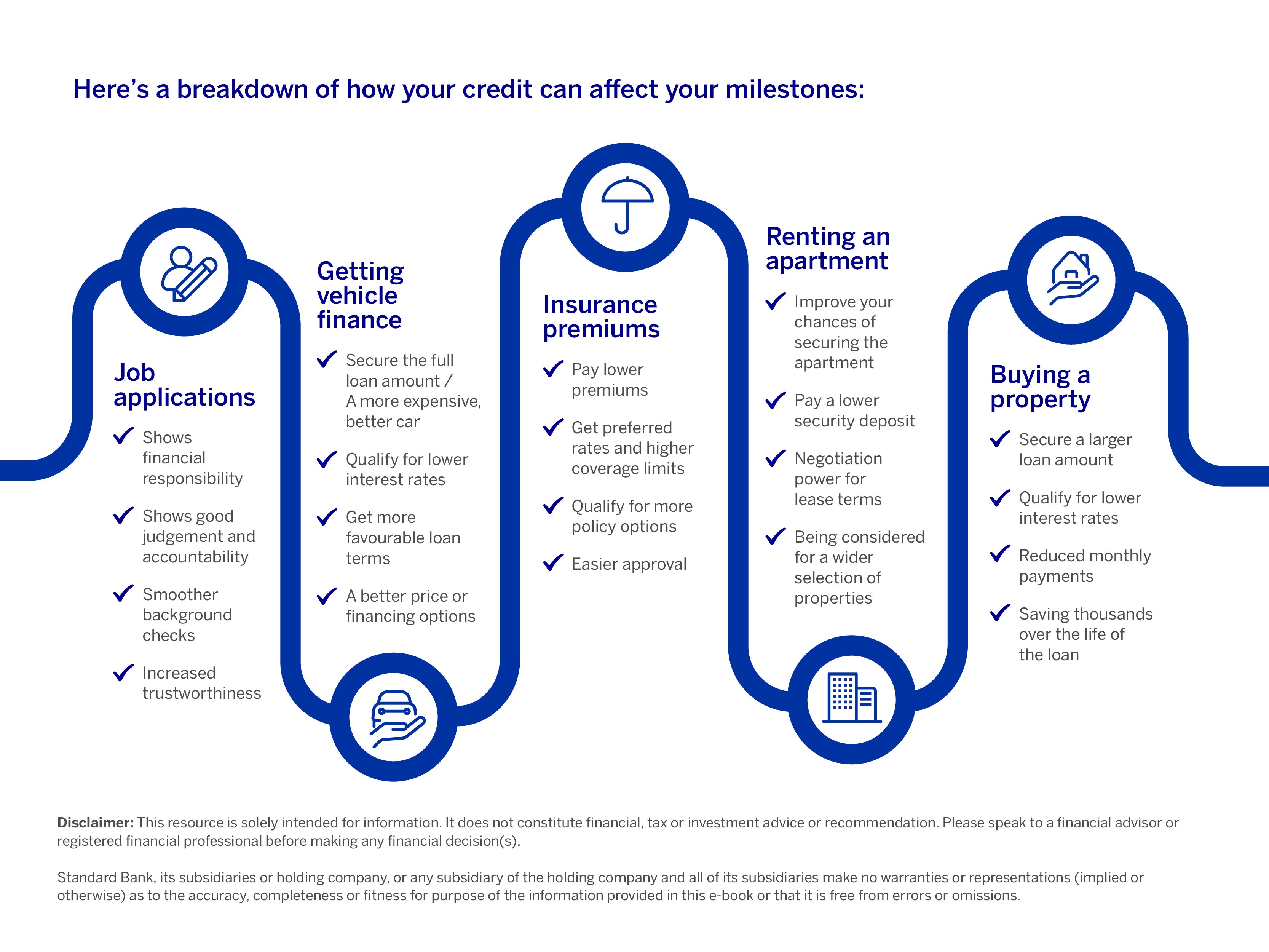

Restricted access to future credit on a personal level means that important loan facilities such as vehicle finance, a home loan, overdrafts and credit facilities like credit cards will no longer be made available to you because you are classified as a risky borrower.

Many companies run credit checks on applicants for new positions, so your job prospects can also be affected by a negative credit score.

If you are a business owner, poor personal credit scores can affect your ability to secure loans for the business or favourable payment terms from suppliers.

Reasons for over-indebtedness

There are several reasons why we are failing to manage our debt responsibly:

- Loss of employment or income if you are retrenched or your business closes down

- Reckless lenders providing credit to individuals who are unable to pay it back (Credit Act)

- Living beyond your means as the cost of living rises

- Irrational and impulsive spending.

3. When is debt good?

Good debt is money that you borrow in order to make more money. It is the type of debt that builds wealth over the long term, leaving you better off than you were.

Think of it as an investment that will grow in value or generate long-term income, such as a student loan (which will help you earn a better income in the long run), or a home loan (which will give you ownership of a property that is likely to increase in value over the years).

Good debt tends to be incurred when buying items of high value, such as a home or a car, with credit making these types of purchases easier to afford as they can be paid off. Remember that Home Loans and Vehicle Finance are more likely to be approved if you have a good track record of paying creditors on time, every time.

To build and maintain a good credit record, manage your accounts and ensure that you pay the entire instalment amount due on time every month.

4. Effective debt management tips

1. Know who you owe money to and how much

- If you are feeling overwhelmed by debt, one of the first steps you’ll need to take to organise your finances, is to determine exactly how much debt you owe, and to whom. Keep an up-to-date list of all your debts, including creditors, total amounts, monthly repayments and deadlines.

- A spreadsheet can be most helpful as it will encourage or compel you to keep your financial obligations up to date. Taking the time to document balances and payment amounts will save you some time later, and help to prevent late payments.

2. Put together a monthly budget

- An effective budget helps you see how much money is coming into your account and how much is going out. You’ll get an idea of what you actually end up with every month, and how much of your debt you can afford to repay monthly.

3. Decide which debts to pay off first

- Prioritise your debt list. Deciding which one to tackle first can be a challenge, but it’s worthwhile to cross them off your list in the right order.

- Some types of debt are more expensive than others, so target the debt that carries the highest interest rate first, and which is costing you the most. Your credit card is often the main culprit. Paying this off first will allow you to save money in the long run.

4. Pay what you can

- While paying a little extra than what you owe every month is ideal – you’ll pay off your debt faster – it’s not always possible. But at least make your minimum monthly payment, to ensure your debt doesn’t grow.

- Again, remember to prioritise paying off additional amounts on interest-bearing accounts first. Some clothing accounts, for example, offer six-month interest-free payment plans, pay off the accounts that charge interest first.

- Missing monthly payments makes it difficult to catch up. If you fail to pay for several months in a row, your account may go into default, which has serious consequences. A minimum payment will stop your debt from growing and will keep your account in good standing. You can always pay more when extra cash is freed up later on. Opting for monthly debit orders can help you keep on track.

5. Curb irrational or impulsive spending

- Set aside an amount you can afford monthly to devote to luxuries or indulging. Creating this small splurge fund or adding a category for indulgences in your budget will allow you to spend money on things you really want, because you only have a set amount to spend.

- Understand your triggers for impulsive spending and devise a strategy to avoid them. For example, set aside a limited amount to go grocery shopping – and a list – so you’re not tempted to window- shop and end up buying something extra, outside your budget.

6. Consider debt consolidation

- Debt consolidation means taking out a new loan to pay off a number of smaller debts. Multiple debts are combined into a single, larger debt, usually with more favorable pay-off terms, such as a lower interest rate or lower monthly payment or both.

- Covering all your outstanding debt using a single loan for a large amount is a simple way to pay all your creditors at once with only one monthly instalment.

- This is why debt consolidation is an attractive option of the over-indebted. This is ideal if you have multiple or high loan repayments, as the lump sum paid to you by a credit provider will minimise your creditors and offer a single interest rate.

- However, if you don’t have your money management under control, debt consolidation may not be the answer. Unreformed irrational spenders may find it difficult to keep up with payments, or even use the consolidation loan on a new purchase. Within a short time, borrowers often find themselves buried deeper in bills because the institutions offering these loans don’t settle debts on behalf of the borrower; instead, the onus is on the borrower to make payments.

- A secured loan is an alternative, where the money you borrow is secured by an asset. This poses less of a risk to the credit provider, making it easier to be approved for this loan.

7. Reward yourself

- Set yourself goals and remember to celebrate – within your means – when you reach major debt reduction milestones. This will help you stay committed and motivated.

Disclaimer: This article is for information purposes only and does not constitute financial, tax or investment advice. Readers are strongly encouraged to seek financial or legal advice before making any decisions based on the content.

Standard Bank, its subsidiaries or holding company, any subsidiary of the holding company and all of its subsidiaries, make no warranties or representations (implied or expressed) as to the accuracy, completeness, or suitability of the content of this article. The use of the article and any reliance on the content is at the reader’s risk.