The link between money and mental health

Worrying about money can be stressful, and in turn, how it makes us feel influences how we spend it, which means that when you’re emotionally impacted by money or debt, it’s likely that managing money could be more difficult.

When money starts affecting your mental health, it knocks your confidence and self-esteem, not just when it comes to finances but in other parts of your life too. Since it plays such a significant role, it can have a big impact on your overall wellbeing.

How financial stress impacts your mental health

Being emotionally affected by your financial situation is a common issue. Struggling with money, worrying about paying bills and meeting your financial obligations can cause anxiety and depression, which take a toll on you and your family.

It can also lead to other behavioural changes, such as overspending, hoarding and the inability to make financial decisions, leaving you stuck and worsening the stress and anxiety.

Even if you’re not struggling with money and are financially stable, it’s possible to feel out of control, guilty and under pressure to maintain that success, with the fear of losing it and constantly thinking of ‘worse case scenarios’ also making you anxious and driving your behaviour.

Money can have an impact on how we act, think and behave

Being comfortable and in control of your finances makes it easier to make better decisions, but the stress of worrying about money impacts your decision-making and behaviour, making you feel out of control, overwhelmed and more likely to make rash decisions.

Coping with money problems when you’re already feeling stressed can also lead you to avoid your financial obligations or take too long to meet them, which makes things worse.

| Dealing with money issues impacts mental health > Mental health impacts how we deal with money |

|---|

Strategies to reduce the impact of financial stress on your mental health

- Acknowledge and understand your relationship with money

This can help you identify the triggers that are causing you stress. For example, overspending can lead to financial stress, which leads to anxiety about how you’re going to pay back the money.

Knowing the cause can help you change your behaviour and lessen its contribution to your feelings. For example, set out a specific amount in your budget for entertainment and then only pay with cash when you go out.

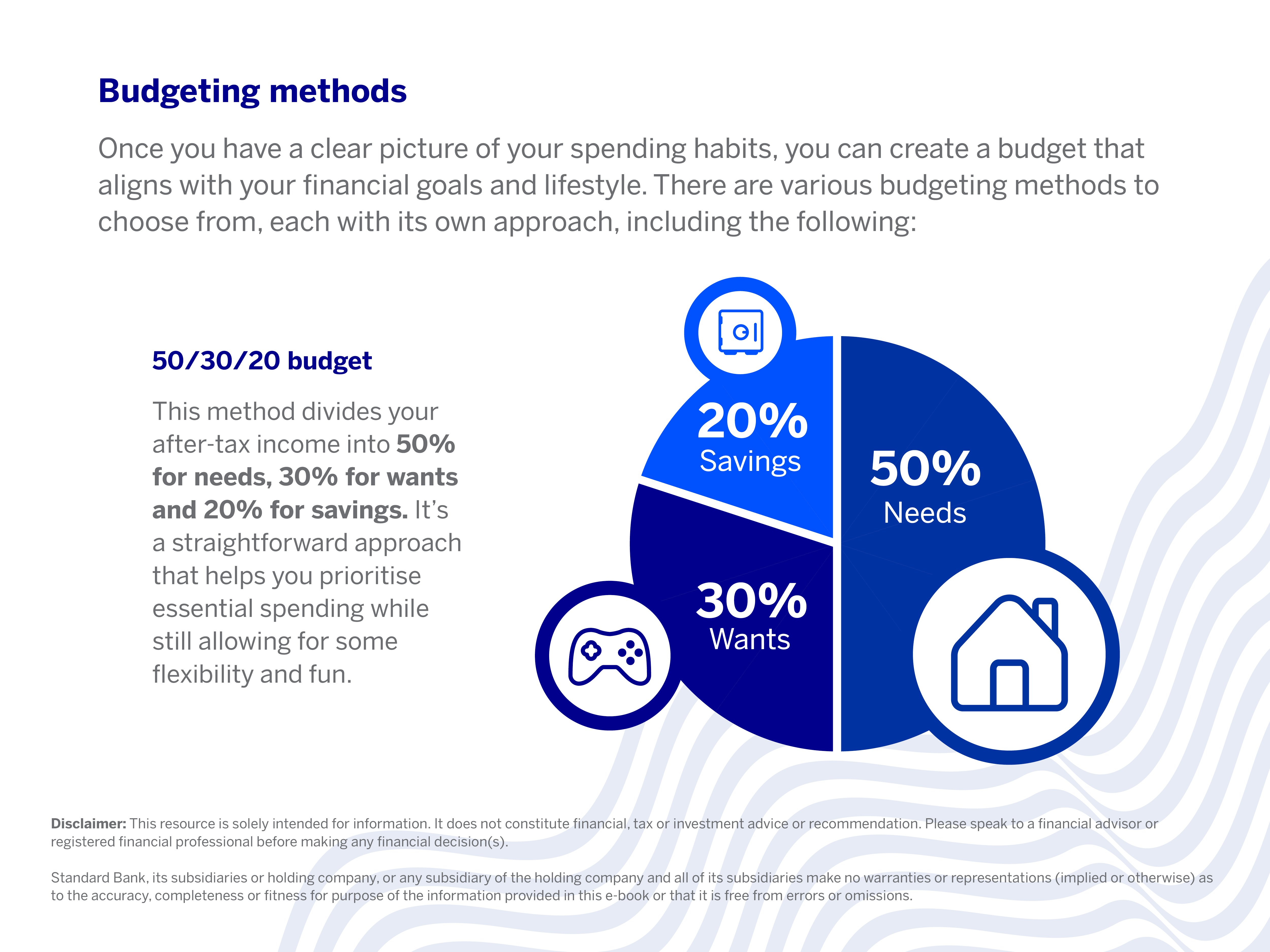

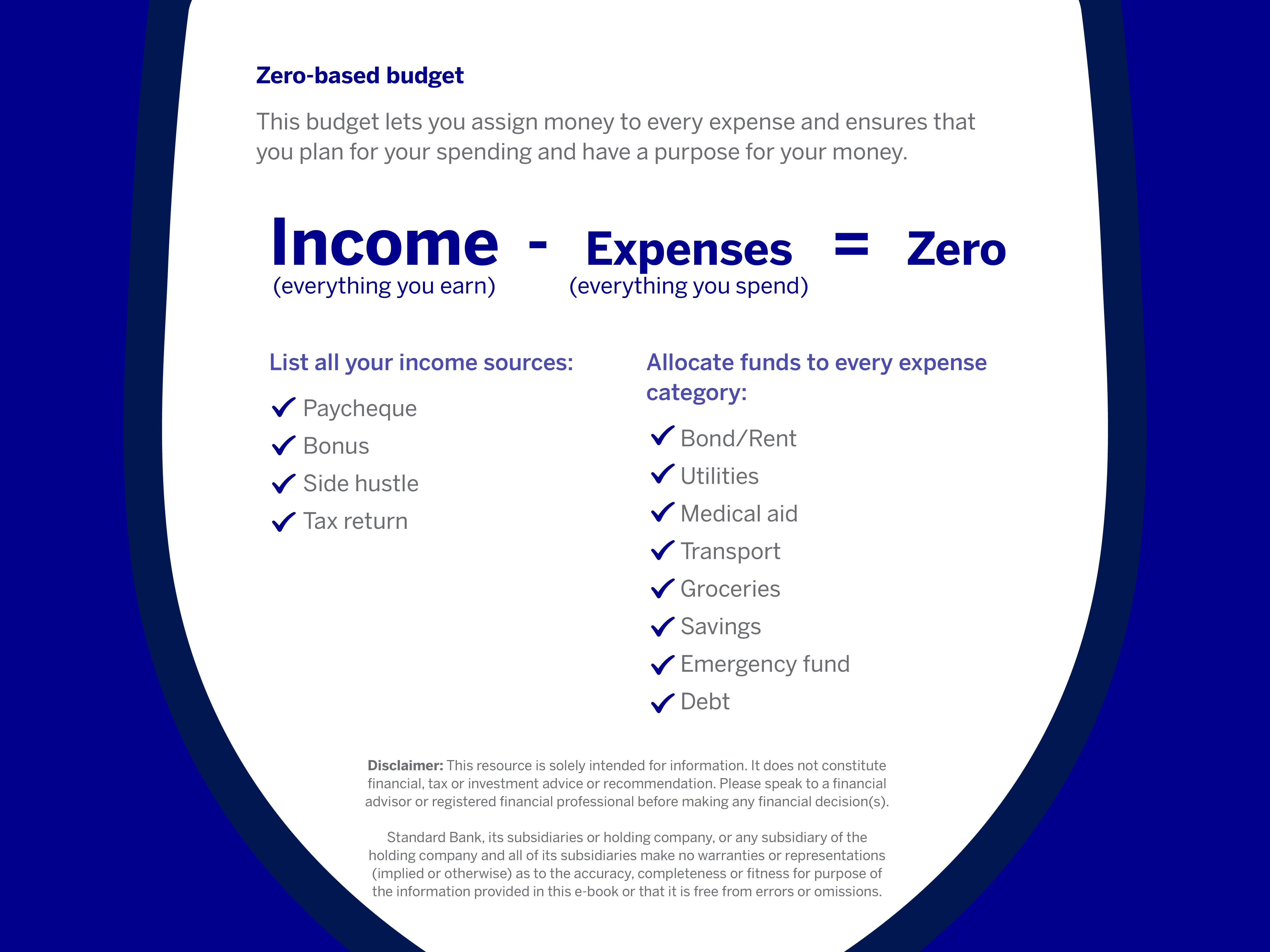

- Budget and monitor your spending

Having a clear view of how much you have and how much you owe is the fastest way of gaining control over your money because you can’t act if you don’t know why you’re doing it. A budget can help you identify areas that you need help with and where you can make small changes to support your bigger financial goals.

- Make one decision at a time

When money and your financial situation become overwhelming and you have multiple choices and obligations, you could feel like you don’t know where to start.

Understand that you won’t solve every problem in one go. Start small by focusing on one financial decision at a time. This will improve your ‘success rate’, which will help you build confidence and take back control of your money instead of it controlling you.

|

Remember: you aren’t alone While money difficulties can create feelings of guilt, shame and failure, know that many people are in a similar situation. You don’t have to deal with this alone either. If you are stressed about money, have mental health concerns, or need help managing your money, reach out to a qualified financial and/or mental health professional to support you through this time. |

Disclaimer: This article is solely intended for information. It does not constitute financial, tax or investment advice or recommendation. Please speak to a financial advisor or registered financial professional before making any financial decision(s).

Standard Bank, its subsidiaries or holding company, or any subsidiary of the holding company and all of its subsidiaries make no warranties or representations (implied or otherwise) as to the accuracy, completeness or fitness for purpose of the information provided in this article or that it is free from errors or omissions.