5 Budgeting tips to help you save

Budgeting can seem like an overwhelming task for some, but in the current economy, personal budgeting is more important than ever.

Budgeting comes down to knowing what you earn and what you spend. It can be a powerful tool to manage your money, as it can help you stay on top of your bills and save up for what you want.

Here are some tips to help you become more financially stable:

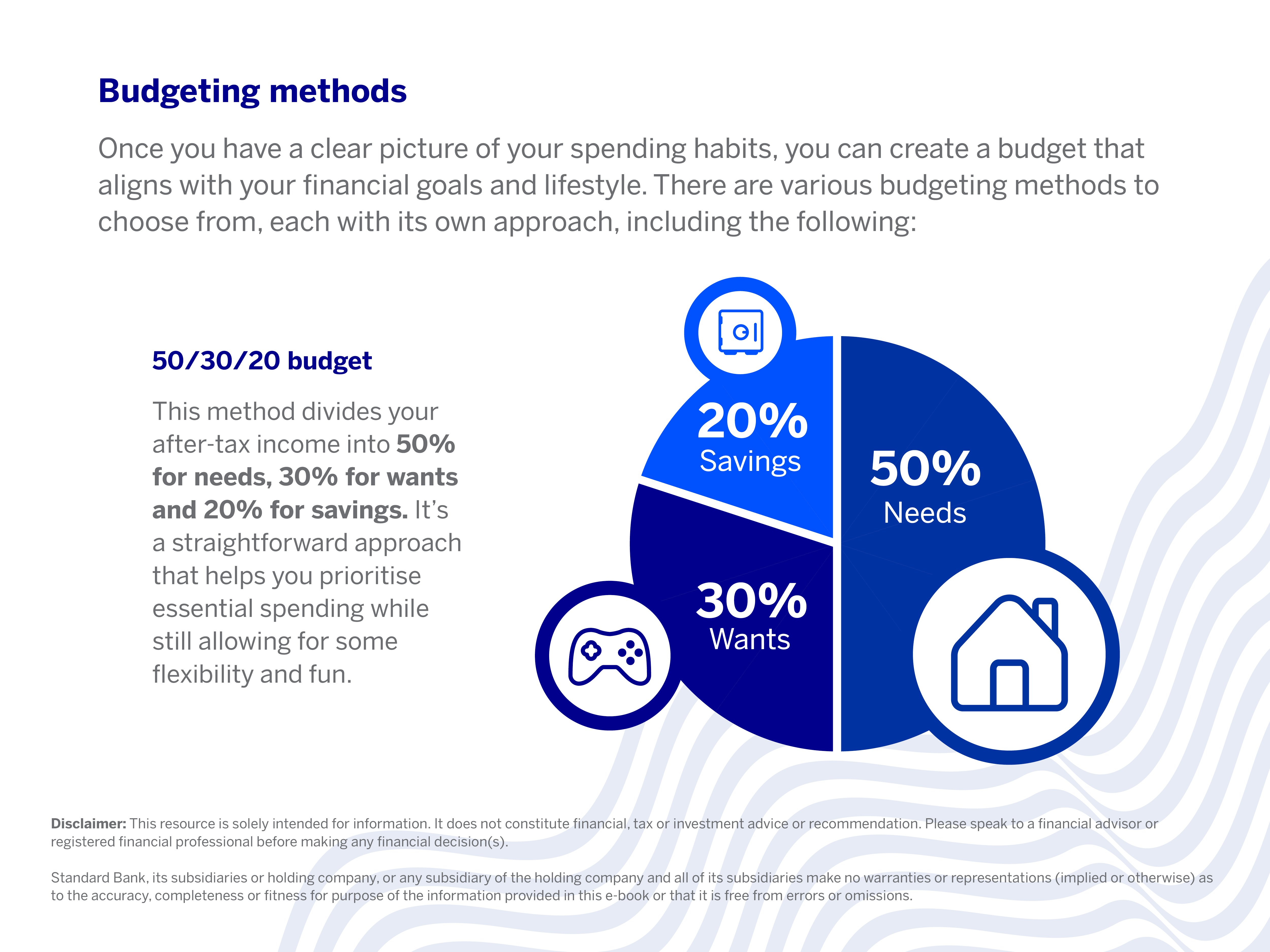

1. Download a budget template that uses the 50/20/30 rule

A budget using the 50/20/30 approach can help you see the ‘big picture’ and is a useful place to start if you are finding it challenging to allocate a total spend to the categories in your budget. In this rule, 50% of your income goes to necessities, 20% to long-term savings, and 30% to lifestyle choices.

If you don’t know where to start, you can download our budget template:

|

Remember, a budget is not set in stone and can be adjusted every month. There will be times when you will have to budget for things such as back-to-school supplies or vacations, birthdays and holidays. Make sure you prepare for these expenses in your budget for that month. |

2. You don’t need to track every expense

The end goal of budgeting is to track your expenses, but you don’t need to account for every rand and cent. For example, keeping a record of the snacks you buy at work could be enlightening, but if it doesn’t alter your spending behaviour, then there’s no point in tracking the expense.

3. Determine where you could be overspending

The average person overindulges in three main categories, namely:

- Dining out

- Impulse purchases of fashion or gadgets

- Entertainment

Once you’ve uncovered your spending habits, you can bring these areas under control and keep a sharp eye on how much you spend per month in each of these categories. This is an easy strategy to implement and can have a significant impact on your finances.

4. Establish your financial goals

Whether you want to have a specific amount in your savings by the end of the year, or you’re saving up for something like a car or new house, you need to be clear about what your goals are to plan properly.

A budget can help you save for a holiday, settle an outstanding debt, put together an emergency fund or get through the month without a negative balance. Having a budget, and knowing where you want to be financially, can keep you focused and motivated to stay on track.

Stay on track with the short-term savings goal checklist.

5. Track your progress

Check your budget every month. If things aren’t going to plan, don’t give up. There are plenty of apps to help you track your budget as you spend daily. You can also use the Budget Manager add-on on your Banking App to help you with your spending habits.

Disclaimer: This article is for information purposes only and does not constitute financial, tax or investment advice. Readers are strongly encouraged to seek financial or legal advice before making any decisions based on the content.

Standard Bank, its subsidiaries or holding company, any subsidiary of the holding company and all of its subsidiaries, make no warranties or representations (implied or expressed) as to the accuracy, completeness, or suitability of the content of this article. The use of the article and any reliance on the content is at the reader’s risk.

Learn how to budget and start saving with our free e-book.