Bank better with our digital finance tools: Part 2

Having the right insights can make all the difference in how you manage your financial journey. With our Banking App, you can plan ahead, stay on top of your finances, and make choices that align with your goals.

Tip: if you haven’t read part 1, we recommend starting there to learn how to track your credit score, anticipate future payments, and understand your spending habits.

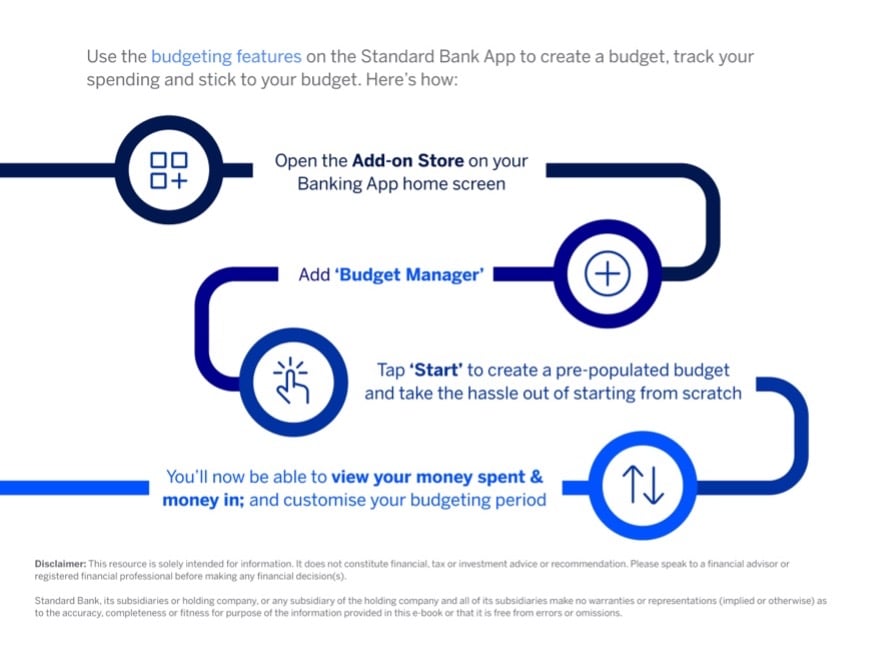

Tool 4: Budget Manager

Budgeting is overwhelming for most people, especially since it requires admin work. That’s where our Budget Manager add-on comes in. By learning from your past spending habits, it helps you create a pre-populated budget that fits your lifestyle.

With this Banking App feature, you can:

- Track your spending

- See how much you have saved within a selected period

- Track your income

- Set savings goals

- Set budget amounts for each category

Tool 5: My360

The My360 add-on gives a complete view of your financial world. From your home and cars to pensions, investments, and even art collections, this feature brings every part of your financial life together in a single, easy-to-read dashboard.

With this Banking App feature, you can:

- Track the progress of your investment goals

- Monitor detailed information about your assets

- Monitor your liabilities

- Get a detailed portfolio view from over 20 000 local and global financial services providers

Plan your future with confidence by adding My360 on your app.

Tool 6: Save & Invest

Imagine turning your financial goals into reality step by step, right from your phone. With the Save & Invest add-on, you can set clear goals, invest in funds that match your risk profile and timeline, and watch your money grow over time.

With this Banking App feature, you can:

- Set goals for your money

- Choose the amount you want to invest and for how long

- Select the product you want to invest in

- View the estimated outcome of your investment

See how close you are to achieving the future you’ve imagined by adding this feature on your app.

Managing your money doesn’t have to be overwhelming. With the full suite of add-ons on our Banking App, you have everything you need to take control of your financial journey.

Disclaimer: This article is for information purposes only and does not constitute financial, tax or investment advice. Readers are strongly encouraged to seek financial or legal advice before making any decisions based on the content.

Standard Bank, its subsidiaries or holding company, any subsidiary of the holding company and all of its subsidiaries, make no warranties or representations (implied or expressed) as to the accuracy, completeness, or suitability of the content of this article. The use of the article and any reliance on the content is at the reader’s risk.

Savings strategies for beginners

Budget like a pro and start your savings journey by downloading our free e-book.