Saving smarter: A simple guide to interest, Taxes and SARS

Saving is a smart move, but understanding how interest works and how it's taxed can help you grow your wealth even faster. This guide breaks down the basics of savings interest, from simple versus compound interest to the tax implications and your responsibilities to SARS.

Understanding interest on your savings

When you deposit money into a savings account, the bank pays you a little extra for holding your money with them. This ‘extra’ is called interest, and it's like a reward for saving. Interest is usually expressed as a percentage per year. The interest you earn builds up daily and is paid to you on specific dates, whether it's monthly, quarterly, twice a year, annually or when your investment matures.

Simple versus compound interest: What's the difference?

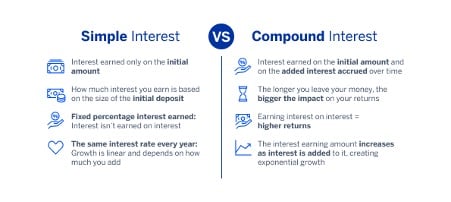

There are 2 main ways interest is calculated:

- Simple interest: Think of this as straightforward interest. It's calculated only on your initial deposit (the principal). It’s the most basic way to calculate earnings on your savings, and since it’s only calculated on the initial amount you put in, it means you earn a fixed amount of interest each period, regardless of any accumulated interest.

Think of it as a steady, predictable return on your investment. You'll often find simple interest used in fixed-term investments, and it’s a good choice when you want to know exactly how much you'll earn over a specific period and don't plan to add any more funds to the investment. - Compound interest: With compound interest, you earn interest on your interest. Let's say you deposit R1 000 into a compound interest savings account at 2%. After the first year, you'll have R1 020. In the second year, you'll earn 2% on that entire R1 020, not just the original R1 000. This snowball effect continues, and your earnings increase over time, even without adding more money. The longer you invest your money, the quicker it will growth.

Which one is right for you? Find out more about how each works and which can help you reach your financial dreams faster.

Examples of compound interest–earning accounts include PureSave, MarketLink, Society Scheme, Tax-free Call and other call deposit accounts such as MoneyMarket Call and MoneyMarket Select. Some of the other advantages of these accounts are that there’s no fixed savings period and you can access and deposit funds anytime. The more money contributed and the longer you stay invested, the higher the return.

Nominal versus effective interest and inflation

Knowing the difference between these concepts helps you to see the real cost of loans and the true return on investments, preventing you from overspending or under-saving by comparing loans accurately, and to choose investments that beat inflation, which could lead to better financial outcomes.

- Nominal interest rate: This is the advertised interest rate before considering inflation. It tells you how much your money will grow in numbers but not necessarily in purchasing power.

- Inflation: This is the rate at which the price of goods and services increases over time. It refers to the reduction in purchasing power (value) of money; therefore, each rand buys you fewer goods and services, making things more expensive.

- Effective interest rate: The effective interest rate is the real rate of return on an investment or the real cost of a loan, expressed as a yearly rate. It accounts for the compounding of interest, giving you a more accurate picture than the nominal rate.

Learn more about interest rates and how they affect your personal finances.

Tax and your savings

When you earn money from your savings and investments, it's important to understand that tax could impact the net return on your savings, which means less money is available to reinvest or spend, ultimately impacting how quickly your wealth grows. Therefore, understanding the tax implication is essential for planning your investments and achieving your financial goals.

You'll need to declare any investment income to the South African Revenue Service (SARS) when you file your annual tax return. The good news is that there are tax-efficient ways to invest, such as the following:

- Tax-free investments: South Africa offers tax-free investment accounts where you can contribute up to R46 000 per year (with a lifetime limit of R500 000) without paying tax on the earnings*.

- Tax benefits on other investments: Even if your account isn't tax-free, you can earn a certain amount of interest tax-free each year. The first R23 800 (R34 500 if you're over 65) of interest income is exempt from tax.

*IMPORTANT NOTICE: The annual limit of R46 000 and lifetime limit of R500 000 apply to the total amount of all your tax-free investment accounts. If you exceed the limit, SARS applies a penalty of 40% on the amount over that limit. Only one Tax-free Call investment account per customer is permitted.

Tax season: Important dates

The tax season (the period when your tax return needs to be submitted) for individuals opens on 1 July and closes on 31 October, and an income tax return detailing the income earned in a tax year needs to be filed with SARS. If you qualify, SARS will complete an auto assessment, making your tax returns easier and quicker.

You can safely and easily access your IT3(b) income tax certificate on our Banking App.

Terms and conditions apply.

Disclaimer: This article is solely intended for information. It does not constitute financial, tax or investment advice or recommendation. Please speak to a financial advisor or registered financial professional before making any financial decision(s).

Standard Bank, its subsidiaries or holding company, or any subsidiary of the holding company and all of its subsidiaries make no warranties or representations (implied or otherwise) as to the accuracy, completeness or fitness for purpose of the information provided in this article or that it is free from errors or omissions.