Explaining investing to children

Understanding money and being financially literate are important for everyone, but in an increasingly complex world, equipping our children with these essential skills from an early age is more crucial than ever.

Teaching your kids about money and investing isn't just about saving for a rainy day; it's about empowering them to better navigate financial complexities and truly understand how their money can grow and work for them. It's about gently guiding children and instilling a mindset of patience, growth and long-term thinking that sets the foundation for a financially savvy future.

Here’s how you can break down investing for young kids.

Talk to your kids about money

Talk about money openly, honestly and often. This helps them understand that money is a fluid tool (one that can be earned, spent, saved, even lost or grown), and by normalising these discussions, you help them develop a healthy, positive mindset towards it so that they don’t fear money.

Investing doesn’t stand in isolation: it is influenced by a variety of financial elements, and therefore, talking about it and encouraging your children to see themselves as active participants in their financial journey give them control over their money story.

Whether it’s deciding how to spend birthday money or setting a savings goal for a desired toy, they're learning to control their financial narrative, which equips them with the building blocks to be able to understand money and eventually take advantage of investing opportunities.

Keep it simple and relatable

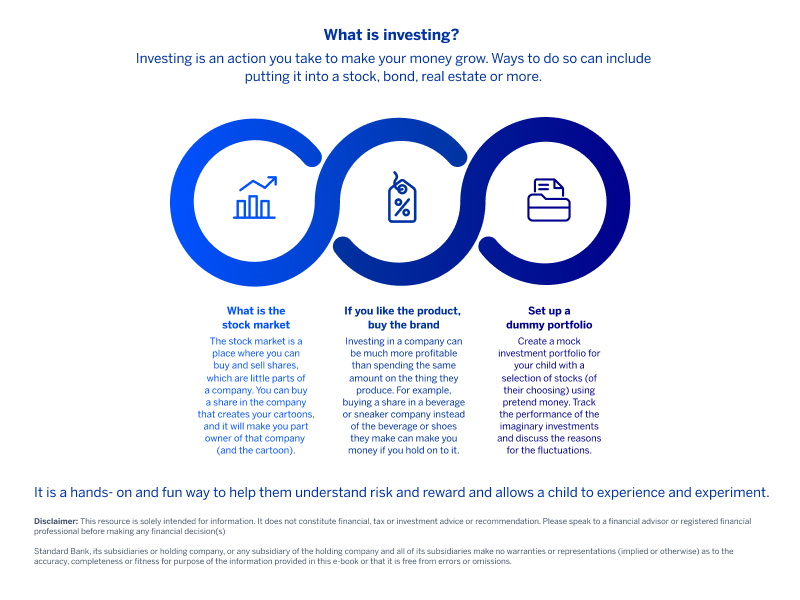

Once you're comfortably chatting about money, the next step is to make the more abstract ideas of investing tangible and easy to grasp. You don’t need to dive into complicated jargon, but starting with the basics will help them become comfortable with the concept and then be able to build on it.

|

Analogies to help explain investing

|

Help them understand the landscape

Explain some of the key elements of investing in an age-appropriate and kid-relevant way. Here’s how you can approach some of the basics around how investing works:

- Compounding: Your money goes to work

When you invest, your money makes more money. Then, that new, bigger amount of money starts making even more money. This keeps happening, making your money grow faster over time. But you need a lot of time for this to happen. - Saving vs investing: Two different missions for your money

Saving is putting money aside and adding to it so you can build up an amount to use for something specific. Investing is putting money aside so that you can grow it and make more money over a longer time. - Diversification: Don’t put all your eggs into one basket

Diversification means spreading your money across different things so that you can grow it safely; for example, imagine carrying all your toys in just one small bag. If the bag breaks or gets lost, all your toys will be gone.

Terms and conditions apply.

Disclaimer: This article is for information purposes only and does not constitute financial, tax or investment advice. Readers are strongly encouraged to seek financial or legal advice before making any decisions based on the content.

Standard Bank, its subsidiaries or holding company, any subsidiary of the holding company and all of its subsidiaries, make no warranties or representations (implied or expressed) as to the accuracy, completeness, or suitability of the content of this article. The use of the article and any reliance on the content is at the reader’s risk.