Preventing lifestyle inflation from sneaking up on you

Lifestyle inflation or lifestyle creep is a phenomenon that affects many people as they progress in their careers and earn higher salaries. As income increases, so does your spending, preventing you from building wealth.

Getting an increase, promotion or side hustle can make you suddenly feel like you can afford (or deserve) that upgrade on your phone, car or house. It’s natural to want to enjoy the fruits of your labour, but it’s important to balance enjoyment with your long-term financial goals.

It’s easy to justify small indulgences here and there, but over time, these expenses can add up and have a significant impact on your finances.

One of the biggest challenges of lifestyle inflation is that it can happen gradually and is difficult to recognise. Wondering whether you’re experiencing lifestyle inflation? Here are some signs to tip you off:

- You earn a substantial salary, but it still feels like you’re living paycheque to paycheque.

- You’re spending more but not saving more.

- Little luxuries have become necessities.

- You’re not reaching your money goals, and your debt is standing still or increasing.

So how do you prevent your expenses from always catching up to your income?

It’s important to set clear financial goals and create a financial plan that reflects your priorities.

Do you want to retire early? Buy a house? Start a business? Whatever your goals, to achieve them, you need to think beyond short-term pleasures and consider your long-term aspirations.

It’s possible to still enjoy your new status, but to enjoy your future goals, you need to take a closer look at current money habits that prevent you from getting there.

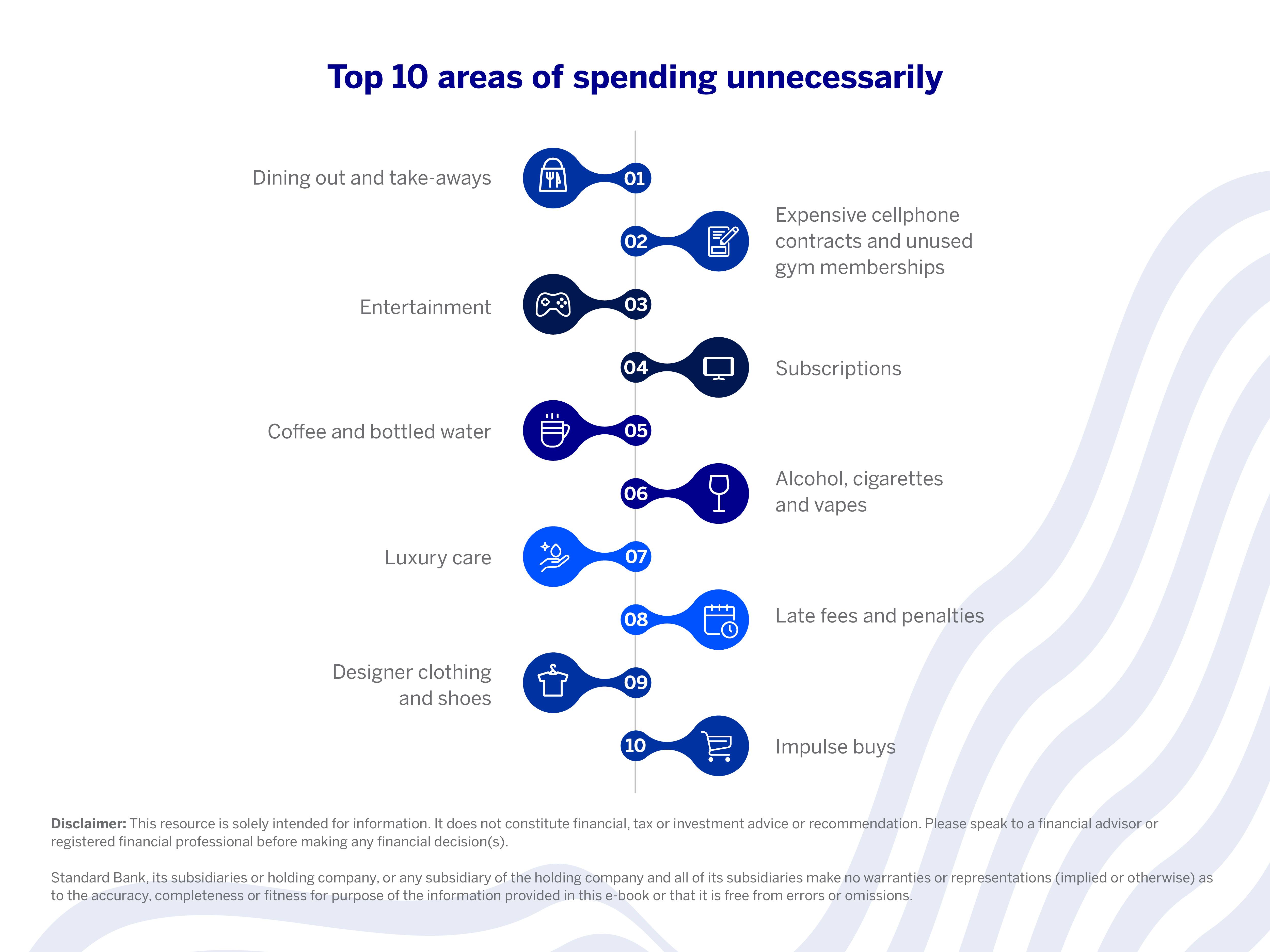

- Creating a budget is an essential tool for managing lifestyle inflation. By tracking your income and expenses, you can identify areas where you may be overspending.

- Review your budget regularly. If your income and/or priorities change, keeping in line with your financial plan can help you stay on track with your long-term goals.

- Another key strategy for managing lifestyle inflation is to focus on experiences rather than material possessions. Buying a new car or designer handbag is tempting but provides only temporary satisfaction. Experiences such as travel and education bring lasting memories and personal growth.

- Avoid comparing yourself to others, especially on social media, as it can create a sense of pressure to keep up with the latest trends and purchases.

Disclaimer: This article is solely intended for information. It does not constitute financial, tax or investment advice or recommendation. Please speak to a financial advisor or registered financial professional before making any financial decision(s).

Standard Bank, its subsidiaries or holding company, or any subsidiary of the holding company and all of its subsidiaries make no warranties or representations (implied or otherwise) as to the accuracy, completeness or fitness for purpose of the information provided in this article or that it is free from errors or omissions.