A guide to Trusts

Imagine knowing your hard-earned wealth will be used to support your family’s dreams for generations to come. A Trust can make that a reality, providing peace of mind that your loved ones will be financially secure according to your wishes and protected from complex and unnecessary taxes and legal battles.

This guide answers common questions about Trusts in South Africa, helping you determine whether a Trust is the right estate planning tool for you.

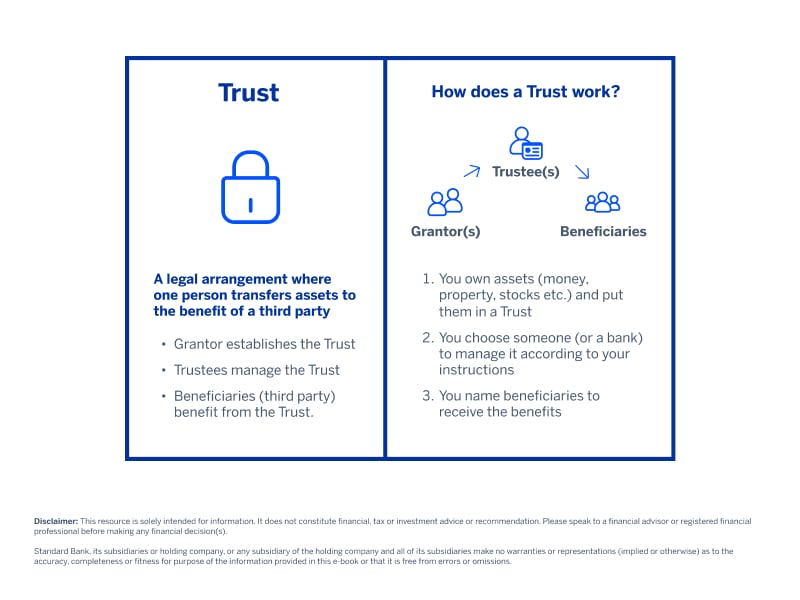

1. What is a Trust, and how can it benefit your estate plan?

A Trust is a legal arrangement that plays a vital role in estate planning, particularly for those seeking estate duty and income tax benefits. As the founder, you transfer ownership and control of your assets to the Trust, managed by Trustees for the benefit of your chosen beneficiaries, according to the terms you set out in the Trust deed.

This roadmap for your assets offers several key advantages, including the following:

- Protecting family wealth: Shielding assets from creditors, lawsuits or even a divorce

- Providing for loved ones: Ensuring financial security for children, dependants with special needs or future generations

- Minimising estate taxes: Potentially reducing the overall taxable value of your estate by divesting yourself of assets and placing them in the Trust as assets within the Trust are not typically subject to the Estate Duty Act 45 of 1955

- Avoiding probate: Streamlining the transfer of assets to your beneficiaries, saving time and money by bypassing the court-supervised legal process of validating a Will

- Maintaining privacy: Keeping your financial affairs private, unlike a will which becomes a public record

- Beneficiary protection: While beneficiaries have a vested right to the assets, those assets don't automatically become part of their estates. The Trust document can stipulate that a deceased beneficiary's share goes to other beneficiaries or their heirs, offering further estate planning flexibility

Think of a Trust as a strategic tool that not only manages your assets according to your wishes but also offers potential tax advantages and protects your family's financial future for generations to come.

2. What are the key benefits of setting up a Trust?

Setting up a Trust can seem complex, but the benefits can be significant. Here’s why it could serve you to set up a Trust in your estate plan:

- Privacy: Unlike a will, the details of your Trust remain private. This prevents public scrutiny of your financial affairs after your death, protecting your family from unwanted attention.

- Estate duty savings: While a Trust shouldn't be solely for tax purposes, it can help minimise estate duty. For example, transferring assets with growth potential to a Trust early on can reduce the taxable value of your estate later.

Note: always consult with a qualified and reputable financial advisor to see whether this strategy is right for you. - Responsible inheritance management: Trusts are ideal for preventing mismanagement of inheritances, especially for minors or individuals who may not be financially responsible.

The Trustees you appoint will manage the assets wisely, ensuring they benefit your beneficiaries as intended. Imagine knowing your children's inheritance is protected from impulsive spending. - Asset protection: Assets held in a Trust are generally protected from creditors. This means that even if your beneficiaries face financial difficulties, their inheritance is safe. This is particularly important for entrepreneurs or individuals in high-risk professions.

- Uninterrupted succession: The death of a beneficiary doesn't disrupt the Trust. The remaining beneficiaries continue to benefit according to the Trust's terms. This ensures long-term financial security for your family.

3. What are the potential challenges of Trusts, and how do you overcome them?

While Trusts offer many benefits, it's important to be aware of the potential challenges:

- Loss of control: When you put assets in a Trust, others manage them for you, but you get to choose who manages them (your Trustees) and tell them how to do it through clear instructions.

- Costs: Setting up and maintaining a Trust involves costs, including legal fees, Trustee fees and potential tax preparation fees. However, the long-term benefits of asset protection and estate duty savings often outweigh these costs.

- Tax implications: Trusts generally face higher tax rates than individuals; careful planning and consultation with a tax advisor or estate planner can help minimise the overall tax impact, including potential capital gains tax (CGT) when transferring assets.

- Not one-size-fits-all: A Trust might not suit every family member's situation, so discuss it openly and seek expert advice to make sure it's the right fit for everyone involved.

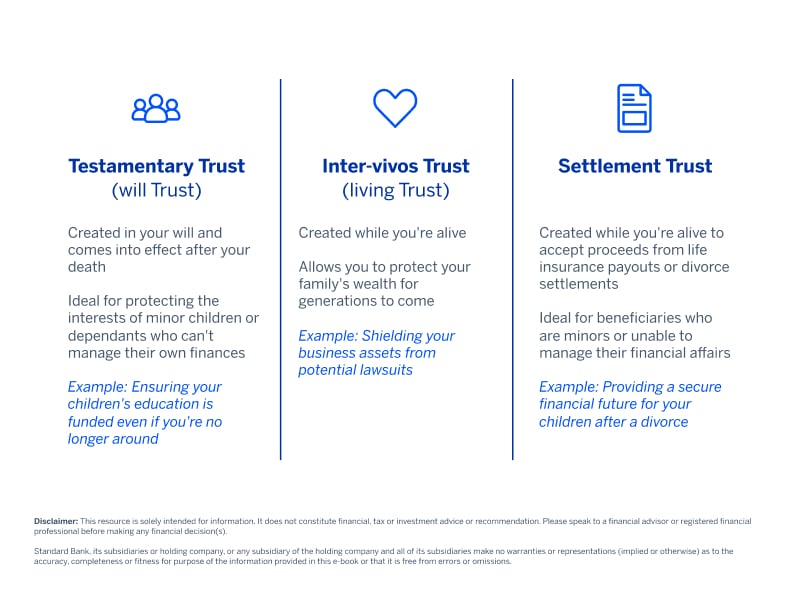

4. What types of Trusts are there in South Africa?

There are several types of Trusts available in South Africa. Here are 3 common options that you can access through Standard Trust, a member of the Standard Bank Group:

5. Why consider professional Trust management?

Setting up and administering a Trust requires in-depth knowledge of South African tax and succession laws. While you can act as your own Trustee, there are significant benefits to appointing a professional Trust management company.

Professional Trust Managers offer expertise to ensure correct selection, drafting, setup and legal compliance, provide unbiased advice, save you time by handling administration, ensure continuity of management and ultimately provide peace of mind knowing your Trust is in capable hands.

Next steps: Is a Trust right for you?

Deciding whether to set up a Trust is a significant decision. It's essential to consider your individual circumstances, financial goals and family needs. If you are choosing to set up a Trust, it’s important to do the following:

- Consult with a qualified estate planner to assess your situation and advise you on the best course of action.

- Speak with a financial advisor to understand the tax implications of setting up a Trust and develop a comprehensive financial plan.

- Talk to your family to ensure everyone is on board with your estate planning decisions.

Disclaimer: This article is for information purposes only and does not constitute financial, tax or investment advice. Readers are strongly encouraged to seek financial or legal advice before making any decisions based on the content.

Standard Bank, its subsidiaries or holding company, any subsidiary of the holding company and all of its subsidiaries, make no warranties or representations (implied or expressed) as to the accuracy, completeness, or suitability of the content of this article. The use of the article and any reliance on the content is at the reader’s risk.