Life insurance made simple

Life is full of twists and turns, and while we can't predict every eventuality, we can prepare for them. A crucial way to do so is through life insurance (life cover) and related protective covers.

This guide will help you understand the different types of life insurance, why they're important and what to expect when considering a policy.

What is life insurance?

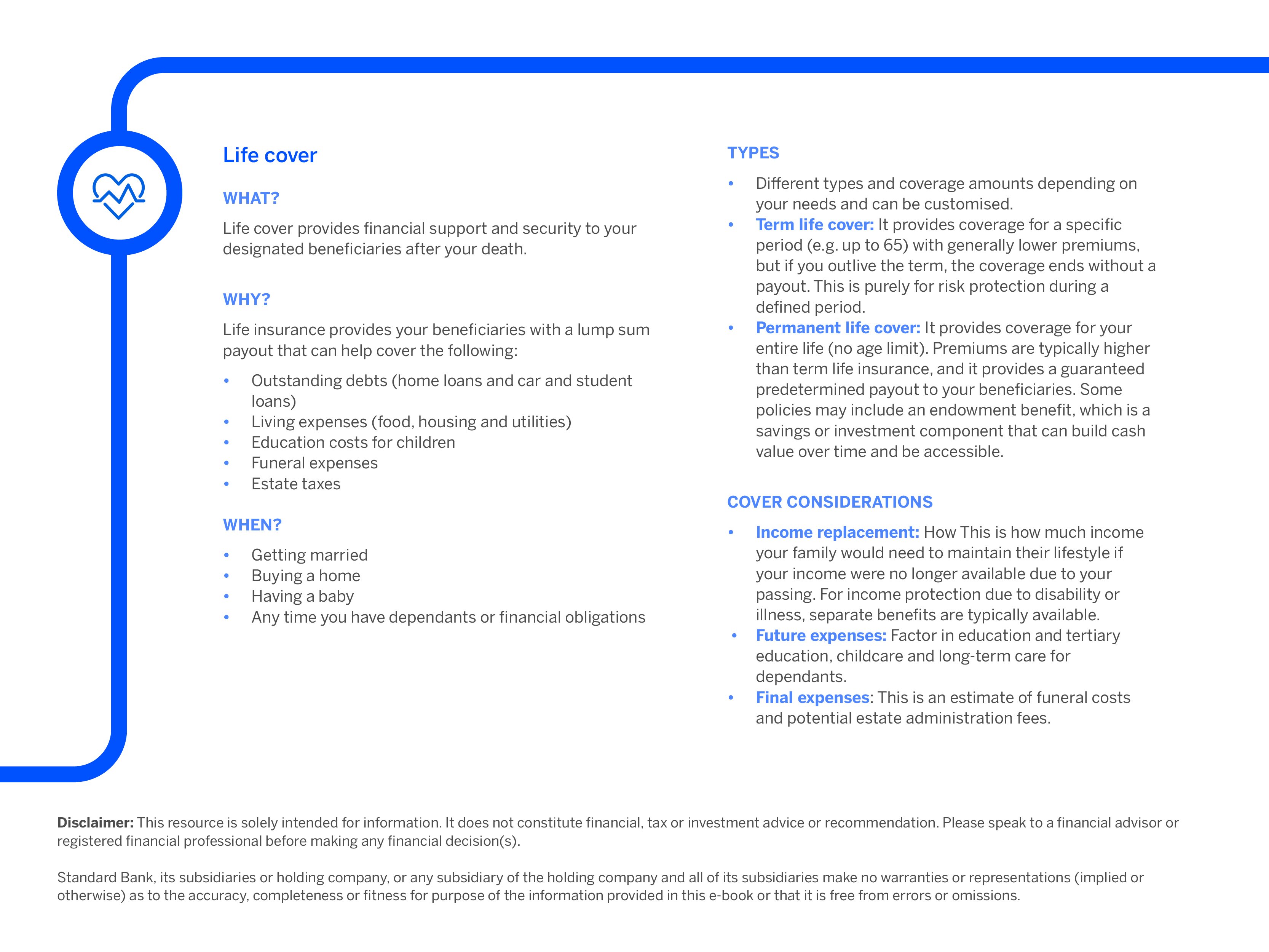

At its core, life insurance provides a financial safety net for your loved ones should you pass away. When you have life cover, a pre-determined sum of money is paid out to your chosen beneficiaries, the people you nominate to get the money, which can be used to do the following:

- Clear outstanding debts, such as home, car and personal loans or credit card balances

- Cover day-to-day expenses to ensure your family can maintain their lifestyle without immediate financial strain

- Cover the immediate expenses associated with your passing, such as funeral and estate costs

- Fund future costs, such as children’s education or simply providing long-term financial security

Understanding the life insurance process

- When you apply, you provide personal details, including your age, health history, family medical history, lifestyle (e.g. smoking and dangerous hobbies) and occupation. Honesty is crucial here: providing false information can invalidate your policy later.

The insurance company uses this information to assess the risk of insuring you. This process is called underwriting, and they use it to determine your eligibility and how much your monthly payments (premiums) will be. While a full medical exam isn't always required, you might need to undergo specific tests, such as an HIV test, within a certain timeframe. The insurer often covers the cost and arranges for convenience. - Once approved, you agree to pay a regular amount (usually monthly) to the insurer. This is your ‘premium’, and as long as you pay it, your coverage is active.

- You also decide who gets the money if you pass away by naming individuals or entities as your beneficiaries.

- Should you pass away, your beneficiaries (or someone acting on their behalf) will file a claim with the insurance company, who will verify the death and confirm whether the policy was paid for and all conditions were met. The agreed-upon death benefit will them be paid directly to the beneficiaries.

How much cover do you need?

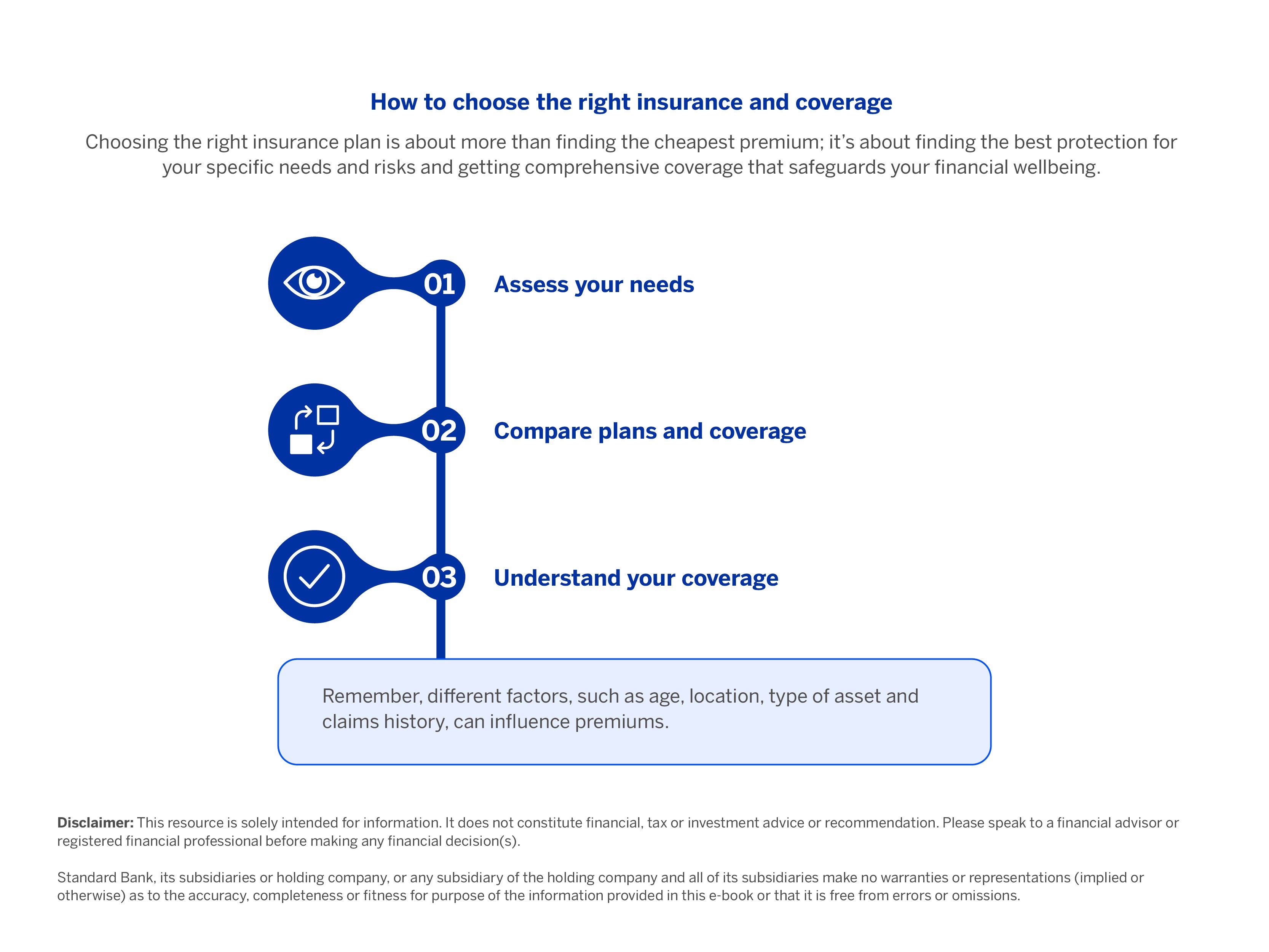

Determining the right amount of cover is a personal decision and depends on your unique circumstances and affordability. Therefore, you should consider your income, debts, family size and dependants, and future financial goals.

Furthermore, your past, present and family medical history, as well as lifestyle considerations, will be included in assessing your coverage, thus determining how much cover you require and what it would cost.

Important considerations

There could be exclusions in your policy, which mean that there are specific circumstances or conditions outlined in your policy under which your life insurance will not provide coverage (such as suicide, fraud or misrepresentation) or pay out a claim (such as illegal activity and undisclosed dangerous hobbies or work).

Protect your family’s financial future today

Get flexible and customisable life cover that changes with your needs and your budget.

*Terms and conditions apply

Disclaimer: This article is solely intended for information. It does not constitute financial, tax or investment advice or recommendation. Please speak to a financial advisor or registered financial professional before making any financial decision(s).

Standard Bank, its subsidiaries or holding company, or any subsidiary of the holding company and all of its subsidiaries make no warranties or representations (implied or otherwise) as to the accuracy, completeness or fitness for purpose of the information provided in this article or that it is free from errors or omissions.

What you need to know about insurance

Learn the essentials of insurance - what it is, how it works and when you need it.