Understanding the difference between loans, BNPL and overdraft facilities

Consumers have a wide range of different credit options to choose from nowadays, including loans, buy now pay later (BNPL) and overdraft facilities. All three are forms of credit that help you finance your purchases over a period, but they have key differences.

Before we get into the key differences between the three, it is important to remember that applying for any type of loan or credit is not something you should take lightly as you don’t want to find yourself trapped in debt.

Here is a look at the difference between loans, BNPL and overdraft facilities as forms of credit.

Loans

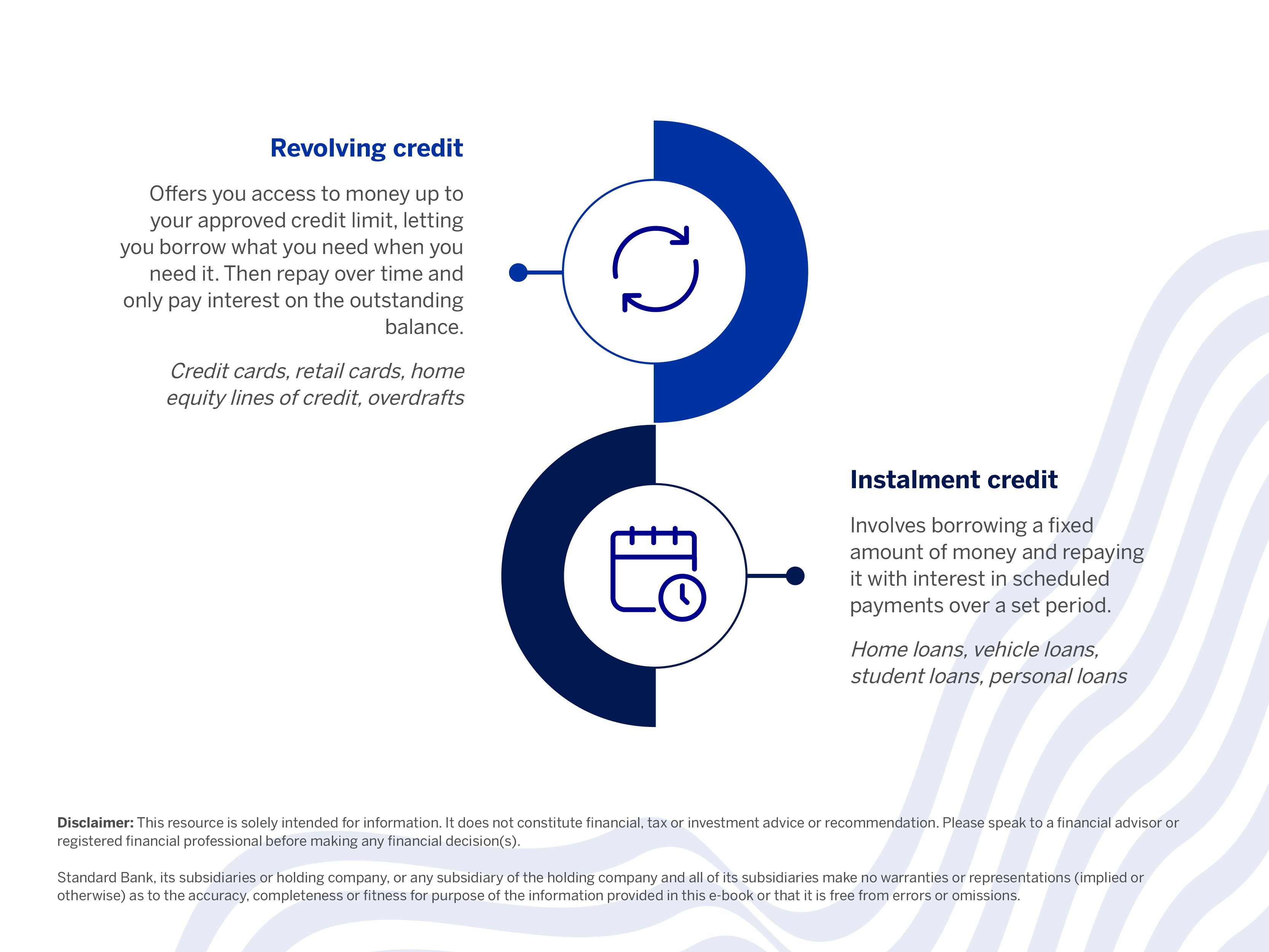

A loan can be used for a variety of purposes, and there are different types of loans that you can apply for, such as personal loans and revolving loans, at most banks and micro lenders. The loan is a fixed amount of money that is borrowed over a period that needs to be paid back in monthly instalments. Approval is dependent on your credit score and credit history.

Some of the advantages of taking out a loan include the following:

- Fixed interest rates, which means your monthly repayment amount will not change over time, making it easier for you to budget.

- Fixed principal amount that will decrease after every payment, which puts you in control of how much you borrow and ensures that you don’t go over your limit.

- Fixed monthly payments over a period you feel comfortable with, usually between 12 and 84 months.

- The option to use your UCount Rewards Points to pay off your monthly instalments if you have a Standard Bank Term Loan or Revolving Loan.

There are some disadvantages to consider, which include the following:

- With the exception of a revolving loan, most types of loans do not provide continuous access to funds. If you need more funds, you will need to apply for another loan.

- If you don’t have a good credit score, you might not qualify for a loan.

- Late or missing payments will negatively impact your credit score and may affect future applications.

Buy now, pay later

As the name suggests, BNPL allows you to make a purchase and delay the final payment. Instead, you have the option to spread online purchases into equal instalments and make weekly or monthly payments towards the balance or postpone a full transaction value to a specified date.

The advantages of BNPL include the following:

- You get to break up the amount into a few instalments.

- Purchases are interest-free (when payments are done on time).

If you do not want to get a credit card or other loan, this may be a good solution for you; however, it is important to be aware of the disadvantages as well, which include the following:

- You may be tempted to spend impulsively.

- Late payments result in late fees, which will negatively affect your credit score.

- To date, there are no rewards or cash earned back on purchases.

- Getting a refund on a defective product can be complicated because you have to communicate with the retailer and the BNPL service.

Overdraft facility

An overdraft facility is a credit facility that exists as an attachment to your current transactional account and provides you with immediate access to money, up to an agreed limit, whenever you may need it.

Some of the advantages include the following:

- You have control over how much you can borrow every month, which allows you to plan and budget accordingly.

- You can manage and track your funds from one account.

- Interest is only charged on the outstanding balance.

- You always have the option to change your limit.

- You won’t miss any payments because the money is already available and is being paid for as money comes into your account.

Some disadvantages include the following:

- You may be tempted to overspend.

- You need a good credit score to qualify for an overdraft.

In a nutshell

Loans can be a good solution for a wide range of purposes, including big financing needs and emergencies, and if you consistently make your payments on time, it will improve your credit score. That said, it wouldn’t be wise to use a loan for smaller purchases, based on the interest charges involved.

On the other hand, BNPL can be a good way to make purchases while managing your finances by spreading out the payment over a few weeks. However, if you are an impulsive spender or someone who struggles with making repayments, you may end up creating even more debt for yourself.

An overdraft facility gives you a flexible source of additional funds that is already linked to your transactional account, making it easier to manage and track your spending. Additionally, you have full control of how much you borrow, so if you are disciplined in your spending, you will not have to worry about getting yourself into more debt.

As with any financial decision, choosing which credit option is best for you should be based on your financial situation and spending habits. Whichever credit solutions you choose, make sure that you have done your research, read the fine print to understand all the charges, avoid over-borrowing and always make your payments on time to avoid getting into even more debt.

Disclaimer: This article is for information purposes only and does not constitute financial, tax or investment advice. Readers are strongly encouraged to seek financial or legal advice before making any decisions based on the content.

Standard Bank, its subsidiaries or holding company, any subsidiary of the holding company and all of its subsidiaries, make no warranties or representations (implied or expressed) as to the accuracy, completeness, or suitability of the content of this article. The use of the article and any reliance on the content is at the reader’s risk.