There’s never been a better time, than now

Whether it’s a trip to a new destination, or a trip in your new ride, owning your first home or owning your hustle – secure your future with our range of financial products designed to make your dreams your reality, today.

Transact and shop for what you want today, while saving and earning interest for tomorrow.

Get a packaged bank account with exclusive benefits at a fixed monthly fee to enable you to build and grow your wealth.

Get up to 1.25%* back in Rewards Points every time you use your qualifying Standard Bank Card to pay for purchases in-store or online.

Get affordable funeral cover that suits your lifestyle and fits your pocket.

Apply for a credit card with a limit of up to R250 000* and enjoy 55 days interest-free*.

Visit mini branches in-store, pay for your groceries with EasyScan, earn double the Rewards Points and more.

Save time and money by applying online for Life Cover and have your premium and cover amount confirmed immediately.

Transform the way you view your financial life. Download My360 and get a comprehensive view of all your money – no matter where you bank or live – from a single touchpoint.

Keep your dreams on course, even when life happens. A Flexi Advantage Investment Account lets you grow your money and access a portion of it without penalties or losing out on interest.

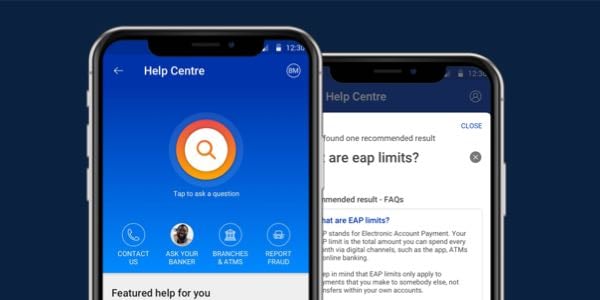

Our new Help Centre on the app lets you easily find help when you need it. Learn more about making the most of our app features to make your life easier.

Sign up for the Standard Bank newsletter to receive the latest bank news and information on exciting new services delivered right to your inbox

A savings account is ideal if you want to keep your money for your future needs, but it’s even better when it helps you grow your money and lets you use it for whatever you need today. When you open a PureSave Account, you get the best of both worlds: transacting and shopping today and savings and earning interest for tomorrow.

With an AccessBond facility on your home loan, you won’t have to take out a personal loan to cover unexpected expenses such as fixing your pool or repairing your roof.

Funerals can be costly, and without the right funeral plan in place, you might leave your loved ones burdened with debt in the event of your death.

Whether you’re upgrading your home, booking a dream holiday, or covering an emergency, a personal loan can help turn plans into reality. But before you apply, it’s worth knowing exactly how they work, from the costs and requirements to the responsibilities that come with them.

Credit card protection is important to protect yourself and your loved ones so that in the event of your death, disability or retrenchment, the outstanding balance on your credit card is covered.

Get rewarded with UCount Rewards Points each time you shop, giving you more to spend on what you want. Here’s how to easily earn and redeem your Rewards Points.

A credit card is a must-have financial tool. Learn more about the reasons to get a credit card.

Wherever you are or wherever you’re going, banking has never been this easy and convenient. With your Standard Bank App, it only takes reaching into your pocket to fulfil your every banking need.

We’re partnering with more retailers so that you can send and receive money quickly and conveniently with Standard Bank Instant Money, anywhere in the country.