How to Set Up an Emergency Cash Fund

Having the right insurance in place can help you absorb the impact of many of life's little surprises. But insurance alone will not cover all expenses, such as having to pay an excess on a claim or car repairs.

Having the right insurance in place can help you absorb the impact of many of life's little surprises. But insurance alone will not cover all expenses, such as having to pay an excess on a claim or car repairs.

When things go wrong, an emergency cash fund lets you take it in your stride. So where do you start?

Emergency cash fund planning

- What expenses to use an emergency fund for

- Paying off debt versus emergency fund savings

- Where to start

- Type of savings account to use for your emergency fund

Want to become a savvy saver? Download our free Savings strategies for beginners e-book today.

Download savings e-book

1. Why you need an emergency cash fund

The idea behind an emergency cash fund is to help protect you in case of any event, big or small, that involves an unexpected expense – which somehow always seems to happen at the most inconvenient time. It’s set up as something to fall back on, and should never be used for a holiday, a shopping spree, or a regular annual expense.

“Many people are caught off-guard by major once-a-year costs like their property tax bill, additional income tax they owe, renewing their car registration, and buying holiday gifts,” says Paula Pant, the force behind Afford Anything, a popular personal finance site. “But these aren’t emergencies.”

Here’s what you should consider an emergency, according to the editors of Kiplinger’s Personal Finance magazine:

- Job loss: To cover all your expenses until you find new employment

- Major health expenses: To cover a doctor, dentist or hospital bill excess that isn’t covered by your medical aid

- Emergency pet care: To cover expensive procedures for your pets

- Car repairs: To cover mechanical expenses that exceed your insurance or that occur out of warranty and maintenance plans

- Home repairs: For those unexpected times when your geyser bursts, or to repair deteriorating structures

- Unexpected tax bill: You could find yourself suddenly owing SARS more money than you anticipated

- A death in the family: This could result in you needing to unexpectedly travel across the world, or cover the costs of a funeral.

2. Paying off debt versus emergency fund savings

Suze Orman, financial advisor and author, advises: “I want you to only pay the minimum due on your credit card balance, and instead, make it your top priority to build as much of an emergency cash fund as you can.” Orman recommends individuals need to save at least eight months’ worth of salary because on average that’s how long it will take for you to find another job.

Trent Hamm from the financial advice website, The Simple Dollar, says that an emergency fund is a significant amount, and a long-term goal for a short-term problem. This goal could be overwhelming for people whose monthly bills and credit card statements are piling up.

The question of whether to pay off debt or set up an emergency fund depends entirely on you. Decide which one you prefer, or which one will keep you disciplined enough to continue to contribute.

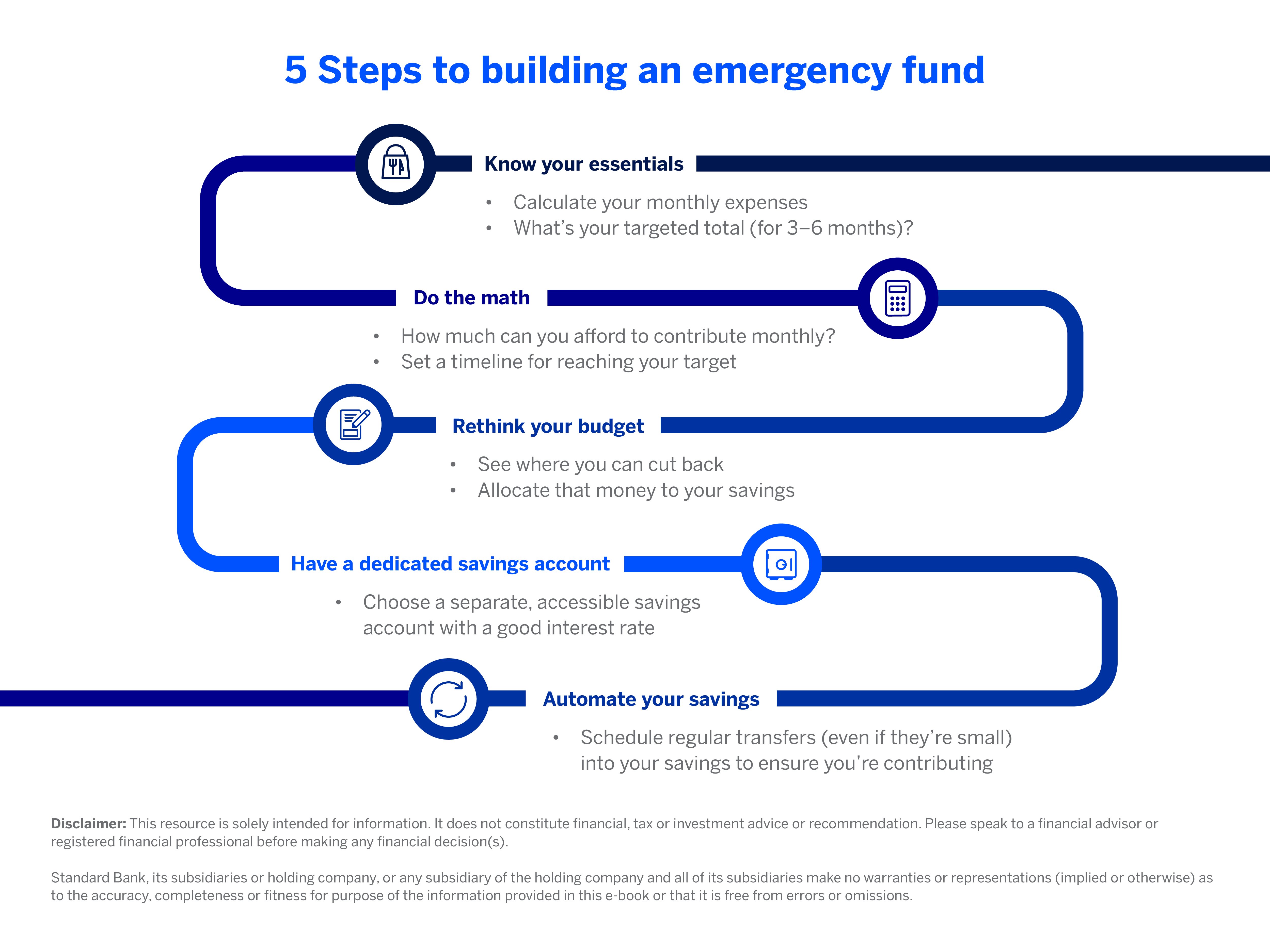

3. Where to start

Before you get started with your emergency cash savings plan, first you need to take a few simple steps to steer you in the right direction:

Set a target

The size of your emergency fund is completely up to you. Saving even small amounts every month eventually adds up – especially if you're putting your money into an account with a good interest rate.

Although saving the equivalent of eight months’ worth of salary could take a long time and be quite challenging to achieve, start with between three and six months’ worth, and focus on contributing no matter how big or small the amount.

Start low and work up from there

Numerous people decide on large goals and then find it challenging to meet them. Instead Hamm advises that you start with something manageable. “Make it your initial goal to have an emergency fund of just R5 000 or R10 000. That’s a goal that you can reach in just a few months (or even less if you’re in a good income situation) and yet it’s an amount that can make a huge difference when you have an emergency.”

Begin saving

You could be saying to yourself: “But I barely make ends meet now, how am I going to save anything significant?” There are plenty of different ways to save money here and there. For example:

- Reduce the amount you owe on your credit card. This will reduce the amount of interest you’re paying every month

- Look for better priced insurance

- Reduce your water and electricity consumption

- Use a list for grocery shopping to curb impulse buys

- Eat in, instead of spending money on dining out

- Carpool with co-workers in your area every day

- When you aren’t travelling far, try using a bicycle; you’ll save on petrol, while exercising

- Reduce unnecessary monthly bills

- If you inherit money or receive a large sum of money, like a tax rebate, deposit it immediately into your emergency fund

Stay on track with the short-term savings goal checklist.

4. Type of savings account to use for your emergency fund

If you’re concerned that you may be tempted to spend the extra cash you’re putting away for a rainy day, a Notice Deposit account may be better suited to you. With a notice deposit, you will only be able to access your funds once you’ve given notice and after a notice period has been served (usually between 6 to 60 days).

You can also make your money work for you by investing it in a high-interest earning account such as a Money Market account or a Flexi Advantage account.

The trick to securing your emergency fund is to forget about the extra cash you’re accumulating each month until it really is an emergency, and then be disciplined to top it up once you’ve dipped into it. This money-buffer will give you peace-of-mind when life throws an unexpected surprise your way.

Disclaimer: This article is for information purposes only and does not constitute financial, tax or investment advice. Readers are strongly encouraged to seek financial or legal advice before making any decisions based on the content.

Standard Bank, its subsidiaries or holding company, any subsidiary of the holding company and all of its subsidiaries, make no warranties or representations (implied or expressed) as to the accuracy, completeness, or suitability of the content of this article. The use of the article and any reliance on the content is at the reader’s risk.

Download our free e-book and learn how to manage your credit responsibly.